Pros

Cons

Quick Summary

| Headquarters Location | International |

|---|---|

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR, NZD + 160 others (some through third party apps) |

| Total Supported Cryptocurrencies | 462+ |

| Trading Fees | 0.0675% - 0.1200% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Banxa, XanPool, MoonPay, Mercuryo, Neofi |

| Support | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android |

Bybit is an established cryptocurrency exchange that stands out in terms of advanced features. This review covers many aspects of Bybit, from its user interface to unique offerings; so that you can gain a full picture of its place among competing cryptocurrency exchanges.

Bybit is a forward-thinking cryptocurrency exchange with an eye towards shifting market needs and user preferences. Their growth trajectory can be observed not only through technological expertise but also through their strategic expansions and partnerships.

Bybit’s dedication to innovation can be seen through its continuous updates and feature improvements, which are designed to enrich trading experiences while fulfilling user demands across its global user base. Bybit has successfully established itself as an exchange that seamlessly serves both retail and institutional clients by acting as an intermediary between traditional finance and the burgeoning digital asset space.

About Bybit

Bybit, with offices in Hong Kong and other locations around the world, such as the United Arab Emirates and Mexico, has quickly established itself in the cryptocurrency industry since its debut. Bybit provides traders with a platform to trade derivatives, including perpetual contracts and inverse futures with high-leverage options.

Bybit is known for its robust trading engine and dedication to providing stable and dependable services.

Bybit has managed to navigate the constantly shifting cryptocurrency environment with skill, often adapting to and capitalising on shifting market trends. Strategic decisions by Bybit, such as adopting derivatives in crypto and meeting the demand for high-leverage options, have contributed greatly to its rise.

Bybit’s journey has also been marked by its resilience during industry shake-ups, maintaining service integrity despite market volatility and regulatory changes. Geographic diversity among its locations (Hong Kong and United Arab Emirates being among them), reflecting Bybit’s global reach as well as crypto derivatives’ cross-border appeal.

Bybit has a number of active social profiles including Facebook, Twitter, Instagram, LinkedIn, Discord, Reddit, Telegram, TikTok and YouTube.

Bybit has a mobile app on both the Apple App Store and Google Play.

Bybit Supported Cryptocurrencies

Bybit supports trading on over 462 cryptocurrencies on their platform. This exchange currently supports 27 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies Bybit supports

- 1INCH

- 1SOL

- 3P

- 5IRE

- AAVE

- ACA

- ACH

- ACM

- ACS

- ADA

- ADA2L

- ADA2S

- AEG

- AEVO

- AFC

- AFG

- AGI

- AGIX

- AGLA

- AGLD

- AIOZ

- AKI

- ALGO

- ALT

- ANKR

- APE

- APE2L

- APE2S

- APEX

- APP

- APT

- AR

- ARB

- ARKM

- ARTY

- ATOM

- ATOM2L

- ATOM2S

- AVA

- AVAX

- AVAX2L

- AVAX2S

- AXL

- AXS

- AZY

- BABYDOGE

- BAR

- BAT

- BBL

- BCH

- BCUT

- BEAM

- BEL

- BICO

- BLUR

- BNB

- BNT

- BOB

- BOBA

- BOME

- BONK

- BTC

- BTC3L

- BTC3S

- BTG

- BTT

- C98

- CAKE

- CANDY

- CAPO

- CAPS

- CAT

- CBK

- CBX

- CEL

- CELO

- CGPT

- CHRP

- CHZ

- CITY

- CMP

- CO

- COM

- COMP

- COQ

- CORE

- COT

- CPOOL

- CRDS

- CRV

- CSPR

- CTC

- CTT

- CULT

- CUSD

- CWAR

- CYBER

- DAI

- DCR

- DECHAT

- DEFI

- DEFY

- DEVT

- DFI

- DGB

- DICE

- DLC

- DMAIL

- DOGE

- DOGE2L

- DOGE2S

- DOME

- DOT

- DOT3L

- DOT3S

- DPX

- DSRUN

- DUEL

- DYDX

- DYM

- DZOO

- ECOX

- EGLD

- EGO

- ELDA

- ELT

- ENJ

- ENS

- EOS

- EOS2L

- EOS2S

- ERTHA

- ETC

- ETC2L

- ETC2S

- ETH

- ETH3L

- ETH3S

- ETHFI

- ETHW

- EVER

- FAME

- FAR

- FB

- FET

- FIDA

- FIL

- FIRE

- FITFI

- FLIP

- FLOKI

- FLOW

- FLR

- FMB

- FMC

- FON

- FORT

- FTM

- FTM2L

- FTM2S

- FTT

- FXS

- GAL

- GALA

- GALFT

- GCAKE

- GENE

- GG

- GGM

- GLMR

- GM

- GMT

- GMT2L

- GMT2S

- GMX

- GNS

- GODS

- GPT

- GRAPE

- GRT

- GST

- GSTS

- GSWIFT

- GTAI

- HBAR

- HERO

- HFT

- HNT

- HON

- HOOK

- HOT

- HTX

- HVH

- ICP

- ICX

- ID

- IMX

- INJ

- INSP

- INTER

- IRL

- IZI

- JASMY

- JST

- JTO

- JUP

- JUV

- KARATE

- KAS

- KASTA

- KAVA

- KCAL

- KCS

- KDA

- KLAY

- KMON

- KOK

- KON

- KRL

- KSM

- KUB

- KUNCI

- LADYS

- LDO

- LENDS

- LEVER

- LFW

- LGX

- LING

- LINK

- LINK2L

- LINK2S

- LIS

- LMWR

- LOOKS

- LRC

- LTC

- LTC2L

- LTC2S

- LUNA

- LUNC

- MAGIC

- MANA

- MANTA

- MASK

- MATIC

- MATIC2L

- MATIC2S

- MAVIA

- MBOX

- MBS

- MBX

- MCRT

- MCT

- MDAO

- MEE

- MELOS

- MEME

- METH

- MIBR

- MINA

- MINU

- MIX

- MKR

- MLK

- MMC

- MNT

- MNZ

- MOVEZ

- MOVR

- MPLX

- MTK

- MUSD

- MV

- MVL

- MX

- MXM

- MYRIA

- MYRO

- NEAR

- NEON

- NESS

- NEXO

- NEXT

- NFT

- NGL

- NIBI

- NYM

- OAS

- OBX

- OKG

- OMG

- OMN

- OMNI

- ONDO

- ONE

- OP

- ORDI

- ORT

- PAXG

- PENDLE

- PEOPLE

- PEPE

- PERP

- PIP

- PLANET

- PLAY

- PLT

- PLY

- POKT

- POL

- PORT3

- PORTAL

- PPT

- PRIMAL

- PRIME

- PSG

- PSP

- PSTAKE

- PTU

- PUMLX

- PYTH

- PYUSD

- QMALL

- QNT

- QORPO

- QTUM

- RACA

- RAIN

- RATS

- RDNT

- REAL

- REN

- RLTM

- RNDR

- ROND

- ROOT

- ROSE

- ROUTE

- RPK

- RPL

- RSS3

- RUNE

- RVN

- SAIL

- SALD

- SAND

- SAND2L

- SAND2S

- SAROS

- SATS

- SC

- SCA

- SCRT

- SD

- SEI

- SEILOR

- SEOR

- SFUND

- SHIB

- SHILL

- SHRAP

- SIDUS

- SIS

- SLG

- SLP

- SNX

- SOL

- SOLO

- SON

- SOS

- SPARTA

- SPELL

- SQR

- SQT

- SRM

- SSV

- STAR

- STAT

- STETH

- STG

- STRK

- STRM

- STX

- SUI

- SUIA

- SUN

- SUSHI

- SWEAT

- SYNR

- T

- TAMA

- TAP

- TAVA

- TEL

- TENET

- THETA

- THN

- TIA

- TIME

- TOKEN

- TOMI

- TON

- TRIBE

- TRVL

- TRX

- TURBOS

- TUSD

- TVK

- TWT

- UMA

- UNI

- USDC

- USDD

- USDT

- USDY

- USTC

- VANRY

- VEGA

- VELA

- VELO

- VEXT

- VIC

- VINU

- VPAD

- VPR

- VRA

- VRTX

- VV

- WAVES

- WAXP

- WBTC

- WEETH

- WEMIX

- WLD

- WLKN

- WOO

- WWY

- XAI

- XAVA

- XCAD

- XDC

- XEC

- XEM

- XETA

- XLM

- XRP

- XRP3L

- XRP3S

- XTZ

- XWG

- XYM

- YFI

- ZAM

- ZEN

- ZEND

- ZETA

- ZIG

- ZIL

- ZKF

- ZRX

- ZTX

Trading Experience

Bybit offers an intuitive user interface for novice and veteran traders. Additionally, Bybit’s high-performance matching engine enables it to process large volumes of trades quickly without lagging in today’s fast-paced derivatives market.

Features such as advanced charting technology, flexible order types and leverage options combine to provide a user-friendly trading experience.

Bybit’s trading experience is tailored to meet the demands of an all-encompassing trading community, from crypto novices to experienced traders. Its high-performance matching engine demonstrates its solid technology foundation and allows Bybit to process large volumes of orders with minimum latency.

Bybit’s engine is a critical element in an economy where timing and price accuracy greatly influence traders’ outcomes. Bybit offers advanced risk management tools—isolated margin features and cross margin features, among them—giving traders flexibility in adapting strategies according to their risk appetite and market view.

Combining advanced technology with numerous trading options creates an adaptable and responsive environment.

Bybit Fees

Bybit is designed to offer competitive fees based on a maker-taker model that incentivizes market liquidity. While specific numbers will not be disclosed here, please remember that trading fees vary based on contract type and nature of trades.

Funding rates also come into play, determined based on market conditions.

Bybit has created a competitive market where fees have the power to significantly influence traders’ decisions, crafting its fee policy to be attractive and fair, seeking to satisfy both market makers and takers equally. By going beyond a standard set of charges that applies uniformly across users, the exchange offers more tailored approaches that align with users’ varying strategies and trading volumes.

Bybit’s fee model was designed to complement the complexity of the trading environments it provides. Nuanced contract details and high leverage can have a major effect on Profit and Loss (P&L) outcomes, so Bybit employs a dynamic funding rate mechanism to keep perpetual contract prices anchored to spot market conditions, an essential aspect for traders monitoring market conditions.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% |

| Deposit Fee (Credit/Debit Card) | 0% |

| Trading Fee | 0.0675% - 0.1200% |

| Withdrawal Fee (Bank Transfer) | 0% |

Bybit supports a range of different cryptocurrencies with varying withdrawal fees. When looking at Bitcoin, their withdrawal fee is 0.0005 BTC. The average across all other exchanges that we've reviewed is 0.000566 BTC. This means Bybit charges below the industry average by 11.64%.

Bybit has a maker/taker fee schedule which you can see below.

| VIP Level | 30–Day Spot Trading Volume (USD) | Taker Fee Rate | Maker Fee Rate |

|---|---|---|---|

| Non-VIP | <100000 | 0.2000% | 0.1500% |

| Non-VIP | ≥100000 | 0.2000% | 0.1000% |

| Non-VIP | ≥275000 | 0.1500% | 0.1000% |

| Non-VIP | ≥550000 | 0.1200% | 0.1000% |

| VIP 1 | ≥1000000 | 0.1200% | 0.0675% |

| VIP 1 | ≥1100000 | 0.0800% | 0.0675% |

| VIP 2 | ≥2500000 | 0.0775% | 0.0650% |

| VIP 3 | ≥5000000 | 0.0750% | 0.0625% |

| VIP 4 | ≥10000000 | 0.0600% | 0.0500% |

| VIP 5 | ≥25000000 | 0.0500% | 0.0400% |

| Supreme VIP | ≥50000000 | 0.0450% | 0.0300% |

| Pro 1 | ≥10000000 | 0.0600% | 0.0500% |

| Pro 2 | ≥25000000 | 0.0500% | 0.0400% |

| Pro 3 | ≥50000000 | 0.0450% | 0.0300% |

| Pro 4 | ≥75000000 | 0.0400% | 0.0300% |

| Pro 5 | ≥100000000 | 0.0150% | 0.0050% |

Security - Is Bybit Safe?

Bybit takes security seriously and utilizes a robust framework – including multi-signature wallets and an insurance fund – to protect client funds. Furthermore, they follow stringent protocols using industry standard technologies to safeguard users’ assets and data.

Bybit’s multi-layered security structure is designed to defend users against cyber attacks in an industry where breaches can have devastating repercussions, providing them with peace of mind in protecting their assets. It goes far beyond protecting wallet addresses and funds within them—it encompasses real-time monitoring systems as well as rigorous operational protocols.

By allocating resources for reactive and proactive security measures, Bybit demonstrates its dedication to safeguarding client funds and maintaining the integrity of its trading infrastructure. Furthermore, its dedication is evident through user-focused initiatives, including regular security awareness communications and tools allowing individuals to protect their accounts against unauthorised access.

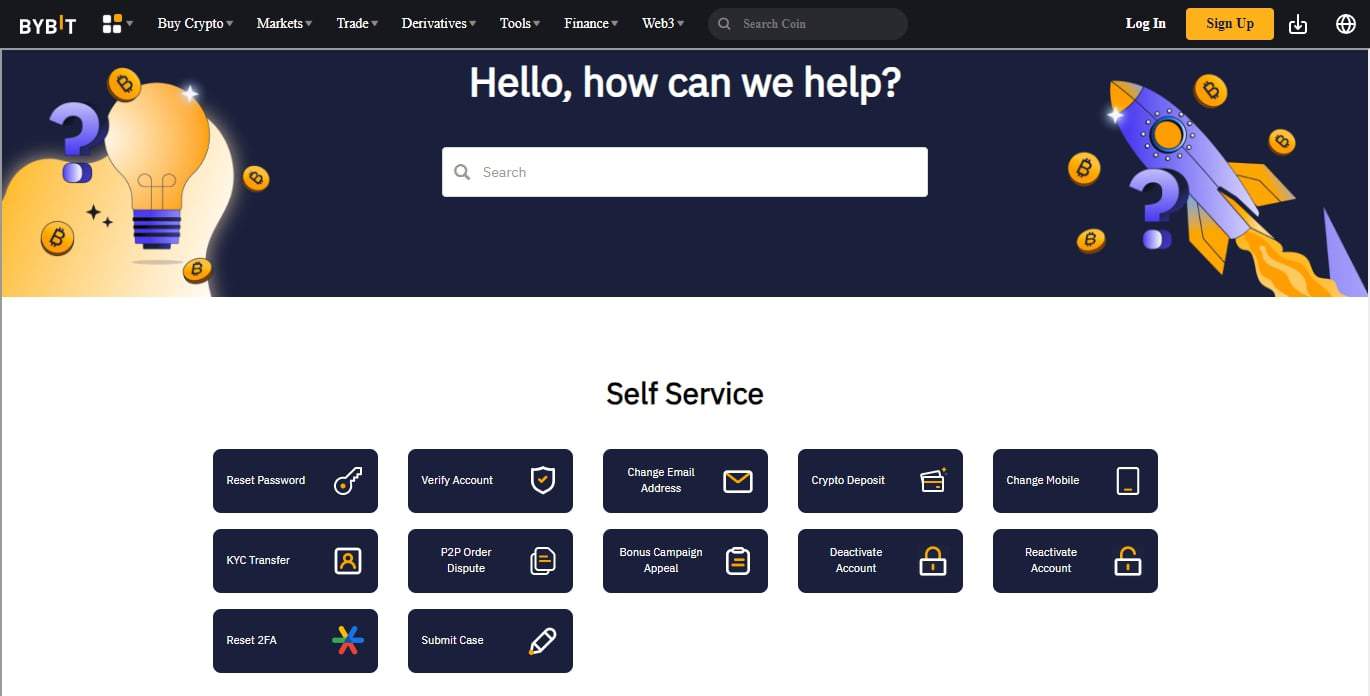

Bybit Customer Support

Bybit stands out in customer support with its responsiveness and helpfulness, providing multiple channels such as live chat and email to assist traders when needed. Industry standards are met by providing traders with assistance whenever required.

Bybit recognizes the significance of reliable customer support, investing in an infrastructure designed to respond swiftly and effectively to user inquiries and complaints. Their service system caters to users across different time zones and languages. As such, they provide quick responses when there are queries or issues with products/services purchased through Bybit.

Bybit provides traders with responsive support channels capable of handling a range of inquiries, from basic platform navigation to complex trading issues. Bybit’s emphasis on customer support contributes positively to user reviews of its platform, making the trading journey even more satisfying for its users.

Bybit Support Channels

How to Sign Up on Bybit

- Create Account - Visit the Bybit website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you can deposit using the deposit methods listed below, including some options through third party apps.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Bybit Alternatives

Binance

Total Supported Cryptocurrencies

386+

Trading Fees

0.10%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

Kraken

Total Supported Cryptocurrencies

244+

Trading Fees

0.08% - 0.40%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 1 other

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Final Thoughts

Bybit is an outstanding platform for traders seeking advanced trading options and high leverage in the derivatives market. Its advanced technology and focus on market depth make it ideal for experienced traders requiring a comprehensive trading environment.

Bybit FAQs

Trust in a cryptocurrency exchange like Bybit is subjective and depends on individual experiences and the specific requirements of the user. It’s important to conduct your own research, consider the platform’s security measures, user reviews, regulatory compliance, and track record in the industry.

Deciding whether to use Bybit or Binance depends on your trading needs, preferences for platform usability, available cryptocurrencies, and customer support. You should compare these features and consider your geographical location as some services may be restricted in certain areas.

The risks of using Bybit include those inherent to cryptocurrency trading such as market volatility and potential for significant financial loss. Additionally, there are risks related to platform security, regulatory changes, and the potential for operational issues that could affect trading and assets.

Yes, users can withdraw money from Bybit. The process involves submitting a withdrawal request and following the platform’s procedures, which typically include security checks and may have conditions such as withdrawal limits or fees.

Bybit was initially established with a team that included founders from China, but it is registered in the British Virgin Islands and has offices in multiple locations globally. The company’s operational base or headquarters location may change over time due to strategic or regulatory reasons.

Regulations regarding cryptocurrency exchanges like Bybit can vary greatly by country and region. Some countries may impose bans or restrictions on the use of Bybit based on local financial regulations.

Users should check the legal status of Bybit in their jurisdiction and comply with their local laws.

The legality of trading on Bybit depends on your country’s cryptocurrency regulations. It is the user’s responsibility to ensure that they are in compliance with their local laws and regulations regarding the use of crypto trading platforms like Bybit.

People use Bybit for various reasons including its user interface, support for a range of cryptocurrencies, and customer service. Users should evaluate whether the platform meets their needs in terms of usability, available features, and compliance with relevant regulations.

Bybit User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Bybit - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.