When exploring the dynamic world of cryptocurrency exchanges, two platforms often come into focus: Coinbase and CoinSpot. Both exchanges serve as significant gateways into the realm of digital assets, offering a plethora of services for users worldwide.

This comparison delves into the nuances of each platform, setting out to illuminate their respective offerings, fee structures, security measures, ease of use, and customer support.

At a glance

| Category | Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | CoinSpot Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | International | Melbourne, Australia |

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR, NZD + 50 others | AUD |

| Total Supported Cryptocurrencies | 243+ | 441+ |

| Trading Fees | 0% - 0.60% | 0.10% - 1% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, PayID, BPAY |

| Support | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full Coinbase review | Read full CoinSpot review |

| Visit | Visit Coinbase | Visit CoinSpot |

About Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Coinbase, established in 2012 by Brian Armstrong, has grown to become a leading American crypto exchange, facilitating the buying, selling, and storage of various digital assets. Known for its user-friendly interface, Coinbase has made significant strides in ensuring a seamless entry for new crypto investors, while also providing advanced features for seasoned traders.

With a wide array of services, including the popular Wallet app and Coinbase Pro, the platform caters to a diverse user base. Coinbase’s commitment to security is evident through features like biometric logins and insurance coverage against theft or cybersecurity breaches. The inception of what would become one of the most prominent figures in the digital asset sphere was marked by simplicity and an emphasis on user accessibility.

This platform’s journey has been punctuated by a series of calculated expansions and integrative partnerships, which have played a pivotal role in its ascension within the cryptocurrency market. The consistent pursuit of innovation has led to the introduction of different products catering to a variety of market participants, ranging from casual investors to sophisticated trading entities.

This exchange’s evolution mirrors the broader cryptocurrency market’s growth and its gradual move towards mainstream financial recognition.

Coinbase Pros & Cons

Pros

Cons

About CoinSpot Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

CoinSpot, in contrast, is an Australian exchange, founded in 2013, which has established itself firmly within the Australian market. It is one of Australia’s most beginner-friendly exchanges, priding itself on excellent customer service and a straightforward interface.

Its adherence to local regulations, being a member of Blockchain Australia, and offering a wide range of cryptocurrencies, including Bitcoin and Ethereum, positions CoinSpot as a favoured choice among Australian users. The exchange has also incorporated robust security measures such as custom withdrawal restrictions and cold storage offline capabilities. With a commitment to serving a specific geographic region, this exchange has tailored its services to align with the financial and regulatory environment of its home country.

The platform has not only adapted to but also influenced the emerging trends and market demands, positioning itself as a gateway to the crypto world for residents within its jurisdiction. It has gained traction by capitalising on local payment methods and forming strategic alliances that reinforce its standing in a competitive marketplace.

The exchange’s history is a testament to its adaptability and customer-centric approach in an industry where regional nuances significantly impact market penetration and user confidence.

CoinSpot Pros & Cons

Pros

Cons

Coinbase vs CoinSpot: Supported Cryptocurrencies

In terms of total cryptocurrencies available, CoinSpot users have access to more cryptocurrencies. Coinbase offers 243 cryptocurrencies whereas CoinSpot supports 441 cryptocurrencies.

For those interested in trading high market cap cryptocurrencies, Coinbase supports 22 of the top 30, compared to CoinSpot which supports 26 of the top 30.

CoinSpot supports quite a lot more cryptocurrencies than Coinbase. With this in mind, CoinSpot has a slight edge for people looking to trade a wider range of coins.

Coinbase vs CoinSpot: Fees

| Fee Type | Coinbase Fees | CoinSpot Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | $0 - $10 | 0% |

| Deposit Fee (Credit Card/Debit Card) | $0 - $10 | 2.58% |

| Trading Fee | 0% - 0.60% | 0.10% - 1% |

| Withdrawal Fee (Bank Transfer) | $0 - $25 | 0% |

Delving into the cost structure of both exchanges, Coinbase and CoinSpot exhibit distinctive approaches to their fee schedules. Generally, both platforms implement a combination of maker-taker fees and flat percentage fees for various transactions.

Coinbase’s fee structure is tiered, changing based on the user’s trading volume, while CoinSpot charges according to the type of trade executed. It’s crucial to note that both exchanges ensure transparency with their fee models, although specifics can vary depending on the user’s location and payment method. The discussion of fees in the realm of crypto exchanges is often a delicate balance between revenue for the platform and value for the user.

While the specifics of fee structures are complex, the principles guiding them reflect a commitment to fairness and competitive positioning in the market. Both platforms under review employ a strategic approach to fees that is designed to incentivise certain types of transactions and trading behaviours, with the aim to cultivate a vibrant and liquid market ecosystem.

Fees are an integral part of the operational framework for these exchanges, and thoughtful consideration is given to their impact on both the user experience and the platform’s financial sustainability.

Coinbase vs CoinSpot: Security

The security infrastructure of both exchanges is robust, with Coinbase and CoinSpot employing industry-standard protective measures. Coinbase offers crime insurance to safeguard digital assets against potential losses from theft, while CoinSpot maintains a strong stance on security, with cold storage solutions and two-factor authentication for all accounts.

While both exchanges strive for the utmost in security, users are always encouraged to utilise all available security features and maintain best practices for personal account safety. Security in the cryptocurrency exchange domain is an ever-evolving battleground, with platforms perpetually enhancing their defences against an array of threats. The exchanges under consideration both employ a multi-faceted security strategy that encompasses not only technological solutions but also operational and procedural safeguards to protect users’ assets.

Beyond the implementation of encryption and authentication protocols, there is a growing trend towards educating users on security best practices, reflecting a holistic approach to risk management. The adoption of these strategies indicates a proactive stance in fostering a secure trading environment, which is paramount in an industry where trust is a key currency.

Coinbase vs CoinSpot: Ease of use

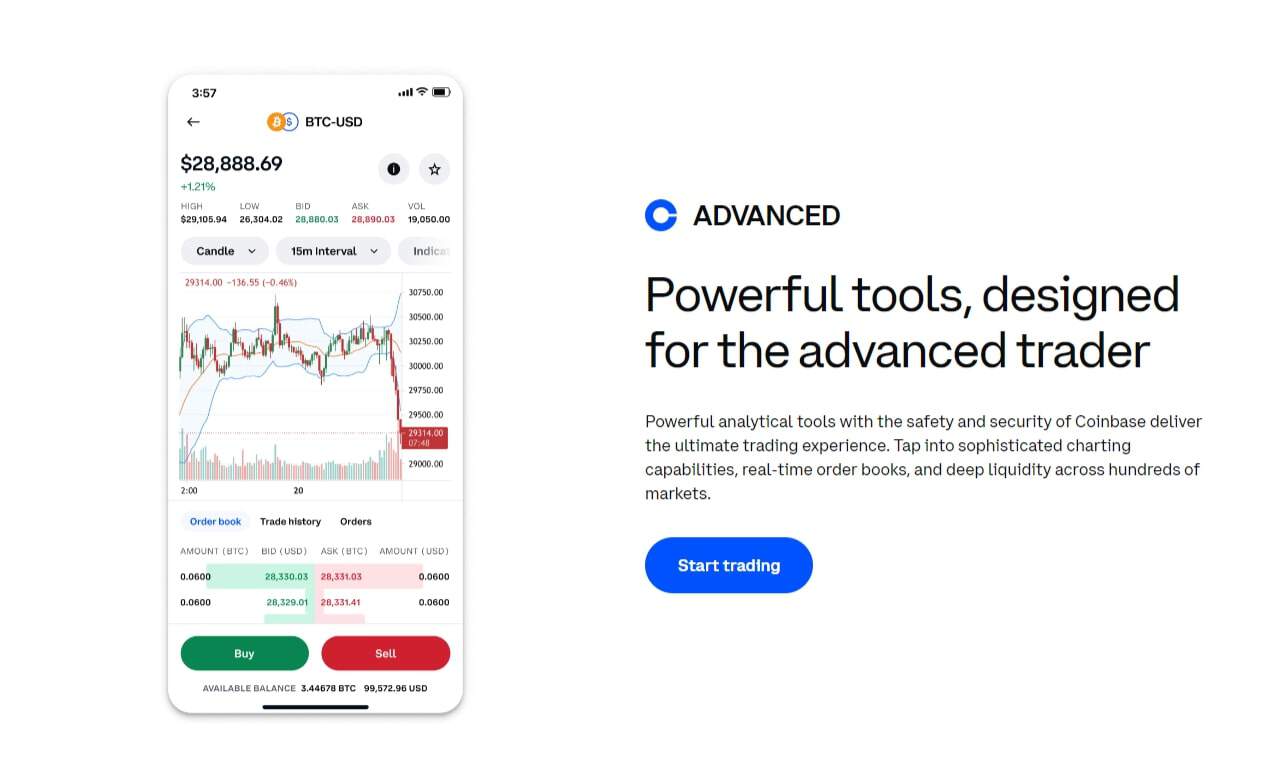

Ease of use is a critical factor when comparing Coinbase and CoinSpot. Coinbase boasts a clean, intuitive interface suitable for both beginners and experienced traders.

Its mobile app is particularly user-friendly, offering full functionality on the go. CoinSpot also offers a streamlined experience, with a straightforward platform that simplifies the process of buying and selling digital assets, especially for users new to the crypto market. The user experience is quintessential to retaining engagement and facilitating the growth of the user base in crypto exchanges.

Both platforms have placed significant emphasis on creating an environment where navigation and transaction execution are streamlined. This dedication to ease of use is manifested through ongoing user interface optimisations and the integration of feedback mechanisms to capture user sentiments.

The goal is to demystify the complexities of the cryptocurrency market, thereby encouraging broader participation and lowering the entry barrier for those on the fringes of the crypto ecosystem.

Coinbase vs CoinSpot: Support

Customer support is a vital aspect of user experience in the crypto exchange world. Coinbase has established multiple channels for support, including a comprehensive FAQ section, email support, and a chat feature.

CoinSpot takes great care to offer dedicated customer service with an average response time that underscores their commitment to their customers. Both exchanges are continually evolving their support offerings to ensure users receive the assistance they need in a timely manner. The provision of support within crypto exchanges is more than a service; it is an extension of the platform’s ethos and a reflection of its commitment to user satisfaction.

Both platforms have built comprehensive support ecosystems that aim to resolve user queries with efficacy and empathy. The focus is on creating a responsive and knowledgeable support network that can guide users through the intricacies of the crypto trading landscape.

With resources devoted to maintaining and enhancing this aspect of their operations, the exchanges affirm the importance of robust support services in establishing trust and loyalty amongst their clientele.

Coinbase vs CoinSpot: Features

When it comes to trading features, both Coinbase and CoinSpot offer a range of tools to accommodate various trading strategies. Coinbase provides a set of advanced transaction types, benefiting experienced traders seeking to execute complex strategies.

CoinSpot, while catering primarily to the Australian market, offers a suite of features that appeal to both novice and advanced users, focusing on simplifying the investment process while still providing the necessary tools for more intricate trades. At the core of each exchange’s offerings is a suite of features designed to meet the varied demands of the crypto community. These range from simple buy-sell operations to more nuanced trading instruments that facilitate advanced trade strategies.

The exchanges have refined their feature sets to cater to both ends of the user spectrum, blending simplicity with depth. This approach not only accommodates the immediate needs of users but also anticipates future requirements, thus ensuring that the platforms remain relevant and efficient in an industry characterised by rapid innovation and changing user preferences.

Final Thoughts

In reviewing Coinbase and CoinSpot, it’s clear that both platforms have carved out their niches in the global crypto exchange market. Each has distinct advantages tailored to the needs of their respective user bases, with Coinbase appealing to an international audience and CoinSpot focusing on the Australian clientele.

Prospective users should consider their specific needs, weighing factors such as fee structures, ease of use, and security features before making a choice. Cryptocurrency exchanges play an indispensable role in shaping the financial landscape of the digital age. As the industry evolves, these platforms will likely continue to refine their services, innovate in the face of regulatory developments, and possibly contribute to the standardisation of digital finance practices.

Their capacity to adapt will be crucial in maintaining relevance within an ever-expanding market that demands both security and accessibility. It is through these lenses that the value and growth potential of crypto exchanges should be examined, with an understanding that today’s landscape is but a snapshot in the rapidly changing vista of digital finance.

Coinbase vs CoinSpot: FAQs

Coinbase, a significant American crypto exchange led by CEO Brian Armstrong, has expanded its services globally, including to the Australian market. Australian users can utilize Coinbase for trading a range of cryptocurrencies and digital assets, with the platform offering an intuitive interface, security features such as two-factor authentication, and insurance to protect certain digital assets against losses from theft or hacking incidents.

However, it’s important to note that trading fees and transaction fees may apply, and users should consider these when trading. Coinbase Australia allows for the trade of popular coins like Bitcoin and Ethereum, but it’s advisable for users to compare features, fee structures, and customer service offerings to other popular exchanges and Australian exchanges like Binance Australia, CoinJar, and Independent Reserve to determine if it meets their specific needs.

Yes, users in Australia can cash out from Coinbase to Australian dollars. To do so, users must have completed all necessary authentication steps and have a compatible external wallet or bank account linked to their Coinbase account.

Coinbase supports a variety of withdrawal methods, and it is essential for users to be aware of any withdrawal fees and restrictions that may apply. For more substantial transactions, Coinbase features enhanced security options such as the Coinbase Vault.

It’s important for users to stay informed and possibly seek professional advice when managing their digital assets and considering cash out strategies.

While Coinbase is recognized as one of the more user-friendly exchanges, offering a variety of features such as a crypto wallet, cold storage options, and the popular Wallet app for mobile devices, there are downsides to consider. These can include higher trading fees compared to some other exchanges, a fee structure that may be complex for some users, and customer service response times that may not meet the expectations of all users.

Additionally, the range of coins and advanced transaction types available on Coinbase may not be as wide as those on other platforms like Binance or Independent Reserve. Users looking for more advanced trading features might opt for Coinbase Pro, which offers a different interface and fee structure.

Currently, Coinbase does not offer direct AUD deposit options to Australian customers. Instead, Australians may need to use a debit card or make a bank transfer in another fiat currency, such as USD, to fund their Coinbase account.

This may involve currency conversion fees. Other local Australian exchanges, such as CoinJar or Independent Reserve, do provide direct AUD deposit options including BPAY and bank transfers.

When considering deposit methods, always review the associated fees, security measures, and any potential impacts on transaction times.

Withdrawal limits on Coinbase can vary based on the user’s level of verification, the chosen withdrawal method, and other factors. Coinbase typically imposes default limits, which can be increased upon request by completing additional verification steps.

Users should refer to the Coinbase Support page for the most up-to-date information regarding withdrawal limits and to review any applicable fees or restrictions that may affect their transactions. It is also prudent to verify whether there are any changes in Australian-specific regulations that may impact withdrawal limits at the time of transaction.

CoinSpot is an Australian-based exchange, known for offering a broad range of cryptocurrencies and digital currencies. As of the time of writing, CoinSpot operates as a privately held company and has not publicly disclosed individual ownership information.

Users often compare CoinSpot to other exchanges like Coinbase and Binance for its user interface, customer service, and range of digital assets. For more detailed information regarding CoinSpot’s ownership and their actual product offering, it’s advisable to reach out directly to their customer service or review their official corporate documentation.

Yes, it is possible for Australian users to open a Coinbase account. Australians interested in using Coinbase will need to go through a sign-up process that includes providing personal information and completing authentication steps, which may involve two-factor authentication and verifying identification documents.

Once the account is set up, Australian users can trade digital assets and utilize Coinbase’s features, although direct AUD deposits may not be supported. For detailed guidance, the Coinbase Support page can provide step-by-step instructions on account creation and setup for Australian users.

As a global crypto exchange platform, Coinbase complies with local regulations in the jurisdictions where it operates. In Australia, Coinbase would have to adhere to the guidelines set by the Australian Taxation Office (ATO), which may include reporting on transactions involving Australian users.

Australian users of Coinbase and other crypto exchanges are required to maintain records of their transactions for tax purposes. It is recommended to seek independent advice or consult with a professional advisor to understand any obligations you may have with the ATO regarding your cryptocurrency transactions.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.