Featured In

AUSTRAC Registered This exchange is registered with AUSTRAC. Digital currency exchange providers in Australia are required to be registered with AUSTRAC. This ensures they must comply with relevant AML and CTF laws or risk facing heavy penalties. You can read more about this on AUSTRAC's website. This registration should not be viewed as an official endorsement or guarantee of services.

Pros

Cons

Quick Summary

| Headquarters Location | Melbourne, Australia |

|---|---|

| Fiat Currencies Supported | AUD |

| Total Supported Cryptocurrencies | 441+ |

| Trading Fees | 0.10% - 1% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, PayID, BPAY |

| Support | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android |

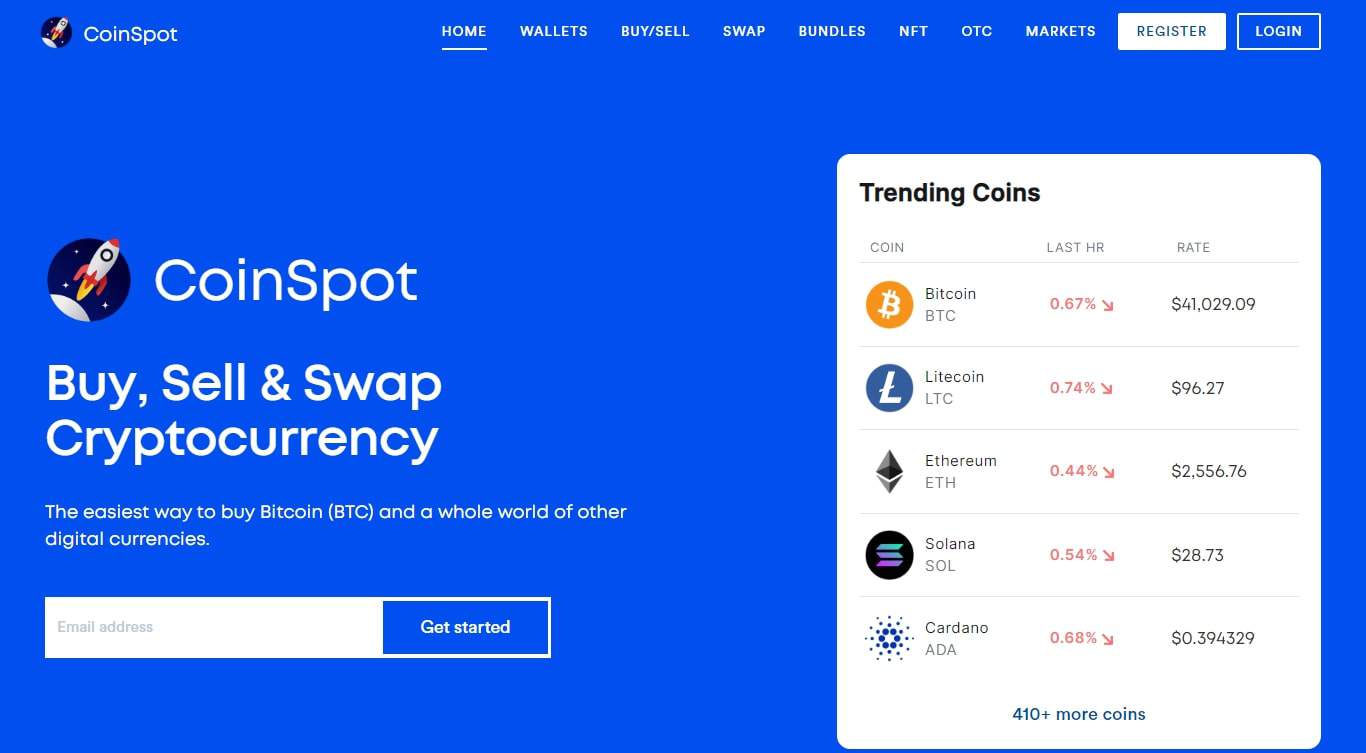

Since its inception in 2013, CoinSpot has become a pillar of dependability within the crypto space. The value they provide extends beyond their intellectual property to encompass the trustworthiness and credibility that have come to define their brand. Boasting certifications from Blockchain Australia and Sustainable Certification, CoinSpot is recognised as an esteemed player among cryptocurrency exchanges.

CoinSpot transcends being merely a crypto exchange platform – it embodies a robust community. When you join this exchange, you connect with an expansive network of customers actively trading within the Australian crypto market.

Despite offering simplicity for user experience, CoinSpot doesn’t compromise on variety. It presents access to 441+ cryptocurrencies and thus serves up ample investment possibilities suitable for traders of all levels and preferences.

About CoinSpot

CoinSpot’s rise to prominence in the crypto space can be attributed mainly to Russel Wilson, who laid its foundations back in 2013. With his IT consultant and entrepreneur background, he steered CoinSpot towards becoming a key player within Australian cryptocurrency exchanges.

The platform has flourished due to its dedication to innovation and unwavering commitment to meeting the needs of those it serves. Targeting exclusively Australian residents, CoinSpot stands out by tailoring its exchange services specifically for them.

Users must provide Australian banking details and local mobile numbers to access their CoinSpot account. This focus is exemplified by offering investment choices originating from Australia and accommodating Self-Managed Super Funds (SMSFs), solidifying its role as an integral contributor to the Australian market.

CoinSpot has a number of active social profiles including Facebook, Twitter, Instagram, Reddit and TikTok.

CoinSpot has a mobile app on both the Apple App Store and Google Play.

CoinSpot Supported Cryptocurrencies

CoinSpot supports trading on over 441 cryptocurrencies on their platform. This exchange currently supports 27 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies CoinSpot supports

- 1000SATS

- 1INCH

- AAVE

- ACA

- ACE

- ACH

- ACM

- ADA

- ADX

- AE

- AERGO

- AGIX

- AGLD

- AGS

- AI

- AIOZ

- AKRO

- AKT

- ALCX

- ALGO

- ALICE

- ALPCA

- ALPHA

- ALPINE

- ALT

- AMB

- AMP

- ANKR

- ANT

- APE

- API3

- APT

- AR

- ARB

- ARDR

- ARK

- ARKM

- ARPA

- ASR

- AST

- ASTR

- ATM

- ATOM

- ATOR

- AUCT

- AUDIO

- AURORA

- AUS

- AVA

- AVAX

- AXL

- AXS

- AZERO

- BAKE

- BAL

- BAND

- BAR

- BAT

- BCAU

- BCH

- BDGR

- BEAM

- BEL

- BETA

- BICO

- BIGTIME

- BLUR

- BLZ

- BNB

- BNT

- BNX

- BOND

- BONE

- BONK

- BRISE

- BSV

- BSW

- BTC

- BTCST

- BTG

- BTS

- BTTC

- BURGR

- C98

- CAKE

- CELO

- CELR

- CFX

- CGPT

- CHESS

- CHR

- CHZ

- CITY

- CKB

- CLV

- COMBO

- COMP

- COQ

- CORE

- COS

- COTI

- CRO

- CRPT

- CRV

- CSPR

- CTK

- CTSI

- CTXC

- CVC

- CVX

- CYBER

- DAG

- DAR

- DASH

- DATA

- DCR

- DEGO

- DENT

- DEXE

- DFI

- DGB

- DIA

- DOCK

- DODO

- DOGE

- DOT

- DREP

- DRGN

- DUSK

- DYDX

- DYM

- EDU

- EGLD

- ELA

- ELF

- ENJ

- ENS

- EOS

- EPX

- ERN

- ETC

- ETH

- ETN

- EWT

- FARM

- FET

- FIDA

- FIL

- FIO

- FIS

- FLIP

- FLM

- FLOKI

- FLOW

- FLR

- FLUX

- FOR

- FORTH

- FRONT

- FTM

- FTT

- FUN

- FXS

- GAL

- GALA

- GAS

- GF

- GFT

- GHST

- GLM

- GLMR

- GLQ

- GMT

- GMX

- GNO

- GNS

- GRT

- GTC

- HARD

- HBAR

- HERO

- HFT

- HIFI

- HIGH

- HIVE

- HNT

- HOOK

- HOT

- HTR

- ICP

- ICX

- ID

- IDEX

- ILV

- IMX

- INJ

- IOST

- IOTX

- IQ

- IRIS

- JASMY

- JOE

- JST

- JTO

- JUP

- JUV

- KAI

- KAS

- KAVA

- KDA

- KEY

- KIN

- KLAY

- KMD

- KNC

- KP3R

- KSM

- LAZIO

- LDO

- LEVER

- LINA

- LINK

- LIT

- LMWR

- LOKA

- LOOM

- LPT

- LQTY

- LRC

- LSK

- LTC

- LTO

- LUNA2

- LUNC

- LYX

- MAGIC

- MANA

- MANTA

- MASK

- MATIC

- MAV

- MAVIA

- MBL

- MBOX

- MDT

- MDX

- MEME

- METIS

- MINA

- MIOTA

- MIR

- MITH

- MKR

- MLN

- MNT

- MOVR

- MTL

- MTV

- MUBI

- MYRIA

- MYRO

- NAKA

- NEAR

- NEO

- NEXO

- NFP

- NIM

- NKN

- NMR

- NTRN

- NULS

- NXRA

- OAX

- OCEAN

- OG

- OGN

- OGV

- OM

- OMG

- ONDO

- ONE

- ONG

- ONT

- OOKI

- OP

- ORAI

- ORBS

- ORDI

- ORN

- OSMO

- OXT

- PAAL

- PENDLE

- PEPE

- PERL

- PERP

- PHA

- PIVX

- PIXEL

- PNT

- POLK

- POLS

- POLYX

- POND

- PORTAL

- POWR

- PROM

- PSG

- PUNDIX

- PYR

- PYTH

- QI

- QKC

- QNT

- QTUM

- QUICK

- RAD

- RARE

- RAY

- RDNT

- REEF

- REI

- REN

- REQ

- RFOX

- RIF

- RLC

- RNDR

- RON

- ROSE

- RPL

- RSR

- RUNE

- RVN

- SAND

- SAVM

- SC

- SCRT

- SEI

- SFP

- SFUND

- SGB

- SHIB

- SHR

- SKL

- SLP

- SNT

- SNX

- SOL

- SOLO

- SOLVE

- SOUL

- SPELL

- SRM

- SSV

- STEEM

- STG

- STMX

- STORJ

- STPT

- STRAX

- STRK

- STX

- SUI

- SUN

- SUPER

- SUSHI

- SXP

- SYN

- SYS

- T

- TAO

- TEL

- TFUEL

- THETA

- TIA

- TKO

- TLM

- TOMI

- TON

- TRB

- TRIAS

- TRIBE

- TROY

- TRU

- TRX

- TWT

- UFO

- UMA

- UNFI

- UNI

- UOS

- USDC

- USDT

- USTC

- UTK

- VANRY

- VET

- VGX

- VIB

- VIC

- VIDT

- VITE

- VOXEL

- VRA

- VTHO

- VXV

- WAN

- WAVES

- WAXP

- WBTC

- WIF

- WILD

- WIN

- WING

- WLD

- WNXM

- WOO

- WRX

- XAI

- XCH

- XCN

- XDC

- XEM

- XLM

- XNO

- XPR

- XRP

- XTZ

- XVG

- XVS

- XYM

- XYO

- YFI

- YFII

- YGG

- ZEC

- ZEN

- ZETA

- ZIL

- ZRX

With CoinSpot, the crypto world is your oyster. As a leading crypto exchange, the platform supports many cryptocurrencies, ensuring a broad selection for traders looking to buy crypto. Whether you’re interested in well-established coins or looking to explore emerging tokens, CoinSpot has got you covered.

Their list of supported cryptos is constantly growing as new cryptocurrencies are rigorously vetted and regularly added to CoinSpot.

Trading Experience

CoinSpot presents sophisticated options and personalised services to meet multiple investment needs and preferences. An eye-catching option is the Bundles feature, which includes pre-selected portfolios aimed at different types of investments. With unique bundles available on CoinSpot, investors can buy and sell various cryptocurrencies simultaneously, each assigned to its individual wallet.

CoinSpot has introduced a crypto MasterCard that simplifies the process of using cryptocurrency for daily purchases. Combined with several other offerings that are explicitly tailored for Australian users, these services significantly enrich the trading experience for CoinSpot’s core audience, establishing it as a favoured platform for more experienced traders within Australia’s cryptocurrency community.

Innovative Tools for Crypto Users

CoinSpot has expanded its offerings to include access to a wide selection of NFT collections by partnering with OpenSea. Thanks to this collaboration, CoinSpot now offers an integrated NFT marketplace where any cryptocurrency can be used to purchase NFTs without incurring hefty gas fees.

Catering mainly to traders who deal in large volumes of fiat currencies, CoinSpot offers Over-the-Counter (OTC) services that ensure price certainty and lower the chance of transaction-related risks.

CoinSpot Fees

When selecting a cryptocurrency exchange platform, the trading cost is a critical factor to consider.

CoinSpot employs a tiered pricing strategy, which enables it to provide robust services on its reliable platform without compromising on offering competitive prices in the marketplace.

Understanding CoinSpot’s Fee Structure

CoinSpot’s pricing model is crafted with its users in mind. When contemplating these transaction fees within their trading framework on CoinSpot’s platform, the users must consider the following:

- The quickness and ease afforded by immediate transactions

- The elevated trading fees applied by CoinSpot add up to the overall transaction costs incurred

- A variable minor mining charge associated with crypto withdrawals that fluctuate according to specific coins involved as well as prevailing network congestion

Although these charges may appear insignificant at first glance, traders on the Coinspot exchange must carefully consider them when making investment decisions.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer - PayID) | 0% |

| Deposit Fee (Credit/Debit Card) | 2.58% |

| Trading Fee | 0.10% - 1% |

| Withdrawal Fee (Bank Transfer) | 0% |

CoinSpot supports a range of different cryptocurrencies with varying withdrawal fees. When looking at Bitcoin, they don't charge anything above the standard Bitcoin network fee. Across all the crypto exchanges we've reviewed, the average Bitcoin transaction fee charged is 0.000461 BTC compared to the actual network fee of 0.000207 BTC. This means you are saving 55.18% on Bitcoin transactions by using CoinSpot instead of other exchanges.

Security - Is CoinSpot Safe?

CoinSpot takes security seriously, implementing robust measures to protect user accounts and data. The platform holds an ISO 27001 certification for its information security management, a testament to its commitment to maintaining a secure platform.

CoinSpot’s commitment to security extends beyond its platform. Through its HackerOne Bug Bounty Program, the company engages security researchers to disclose vulnerabilities responsibly.

To set up an account with CoinSpot, Australian residents aged 16 or older must provide a valid ID to complete the necessary KYC verification for account establishment. Usually, this process wraps up within just a few hours. It might extend up to two full days on occasion. The rigor of this procedure safeguards the coinspot platform’s security and integrity.

Ensuring the Safety of Funds

CoinSpot prioritises the protection of its users’ funds by storing most digital assets in highly secure, off-the-grid storage solutions for digital assets. This ensures that an overwhelming portion of the client’s assets will remain protected and inaccessible even if a security compromise occurs.

CoinSpot strengthens account defense mechanisms through the mandatory application of two-factor authentication (2FA), which serves as a robust verification tool to confirm user identities and block unauthorised entries. To ensure safety, CoinSpot secures its data centers (where it keeps private keys and sensitive details) with top-tier security accreditations such as ISO 27001, 27017, 27018, and PCI DSS standards.

To these measures, the company integrates biometric security features within its mobile app interface, designed with user convenience in mind. Such measures show the company’s dedication to safeguarding clients’ funds, including bank account information and direct deposit bank transfer activities.

Compliance and Certifications

CoinSpot demonstrates its dedication to security by adhering strictly to the regulations set forth by supervisory entities. Since May 8, 2018, CoinSpot has been acknowledged as a Digital Currency Exchange registered with AUSTRAC and consistently maintained compliance with financial crime laws in Australia.

In its legal operation within Australia, CoinSpot ensures that:

- Its transactions are subject to capital gains and nation-wide income tax laws.

- It rigorously evaluates and routinely subjects its information security management systems to audits to preserve ISO 27001 certification standards.

- External auditor SCI Qual International has conferred certifications on CoinSpot that confirm its commitment to upholding stringent security and regulatory conformity.

CoinSpot Customer Support

CoinSpot has dedicated customer support and is accessible through various avenues. The support team stands ready day and night to address any issues or concerns users may encounter.

For those seeking immediate answers outside direct interaction with the support team, CoinSpot also offers a detailed support page filled with FAQs and instructional guides that efficiently facilitate the quick resolution of common queries.

CoinSpot Support Channels

The CoinSpot App Mobile Experience

Recognising the importance of mobility in managing cryptocurrencies, CoinSpot offers its app across both key mobile platforms (iOS and Android) to cater to a diverse user base.

This app retains many features that are available on the desktop version. It facilitates real-time purchase and sale transactions, fund management, including deposits and withdrawals, and wallet oversight for tracking digital assets.

The CoinSpot mobile app lets you control your crypto investments wherever you are, providing convenience without compromise.

How to Sign Up on CoinSpot

- Create Account - Visit the CoinSpot website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the deposit methods listed below.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

CoinSpot Alternatives

Swyftx

Total Supported Cryptocurrencies

350+

Trading Fees

0.1% - 0.60%

Fiat Currencies Supported

USD, AUD, NZD

Binance

Total Supported Cryptocurrencies

386+

Trading Fees

0.10%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

Bybit

Total Supported Cryptocurrencies

462+

Trading Fees

0.0675% - 0.1200%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 160 others

Final Thoughts

CoinSpot has established itself as a premier destination within the cryptocurrency exchange realm. It is characterised by an intuitive, user-friendly interface that caters to the needs of both novice and veteran traders. It boasts an extensive selection of cryptocurrencies and cutting-edge functionalities designed for various levels of trading expertise.

With its ISO 27001 certification and comprehensive security protocols, CoinSpot reassures users with high protection standards while adhering strictly to Australian regulations regarding financial crimes.

A strong proponent of the Australian crypto market, CoinSpot differentiates itself through innovative offerings such as Bundles and the convenience offered by a cryptocurrency MasterCard. Its competitive fee structure and proactive customer service also enhance its appeal among those interested in diving into or continuing their journey through cryptocurrency exchanges.

Are you curious to see how CoinSpot compares to its crypto market competitors? Our articles offer comprehensive comparisons between Binance vs. CoinSpot, Coinbase vs. CoinSpot, CoinJar vs. CoinSpot, and CoinSpot vs. BTC Markets.

CoinSpot FAQs

Trustworthiness can be subjectively assessed by individual users, but CoinSpot is a well-known cryptocurrency exchange in Australia and has been operating since 2013. It has built a reputation over time and is generally considered reputable within the Australian crypto community.

CoinSpot also complies with Australian laws and regulations which adds a layer of trust for Australian users.

CoinSpot takes security seriously and has various measures in place to protect users’ funds. While no major publicised hacking incident has been reported against CoinSpot, it’s important for users to continuously monitor their accounts and use all the security features the platform provides to protect their investments.

Yes, CoinSpot is legal in Australia. It operates as a registered cryptocurrency exchange and complies with Australian laws, including those related to financial services and anti-money laundering (AML) regulations.

Avoiding fees entirely may not be possible as most exchanges charge for various services. However, CoinSpot offers different transaction methods, some of which have lower fees than others.

For instance, using Market Orders often incurs lower fees compared to Instant Buy/Sell. Additionally, depositing funds through certain means such as POLi, PayID or direct deposits may attract less or no fees, compared to other methods.

The minimum withdrawal amount from CoinSpot can vary depending on the cryptocurrency. For Australian dollars (AUD), the minimum withdrawal is typically set to a value that may change over time, so users should check the current terms on the CoinSpot platform.

CoinSpot charges withdrawal fees for transferring cryptocurrencies to external wallets, which vary depending on the blockchain network of the specific cryptocurrency. For withdrawing Australian dollars to a bank account, CoinSpot offers this service for free.

CoinSpot provides various order types for trading, but users should confirm directly on the platform whether stop loss orders are currently supported, as available trading features may be updated or changed.

CoinSpot User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for CoinSpot - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.

Best Cryptocurrency Exchange in Australia

Best Cryptocurrency Exchange in Australia