In the evolving landscape of digital currencies, Australia has seen a significant surge in the use of cryptocurrency exchanges. Among them, CoinJar and CoinSpot have emerged as prominent platforms for Aussie traders looking to dive into the crypto market.

In this article, we compare these two Australian crypto exchanges to give you a comprehensive understanding of their offerings, from user experience and features to fees and security.

At a glance

| Category | CoinJar Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | CoinSpot Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | Melbourne, Australia | Melbourne, Australia |

| Fiat Currencies Supported | USD, AUD, GBP, EUR | AUD |

| Total Supported Cryptocurrencies | 68+ | 441+ |

| Trading Fees | 0.02% - 0.10% | 0.10% - 1% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Osko, PayID, Apple Pay, Google Pay, Faster Payments, Blueshyft, Google Pay, Apple Pay, EML | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, PayID, BPAY |

| Support | Facebook, Twitter, Instagram, Help Center Articles, Support Ticket | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full CoinJar review | Read full CoinSpot review |

| Visit | Visit CoinJar | Visit CoinSpot |

About CoinJar Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

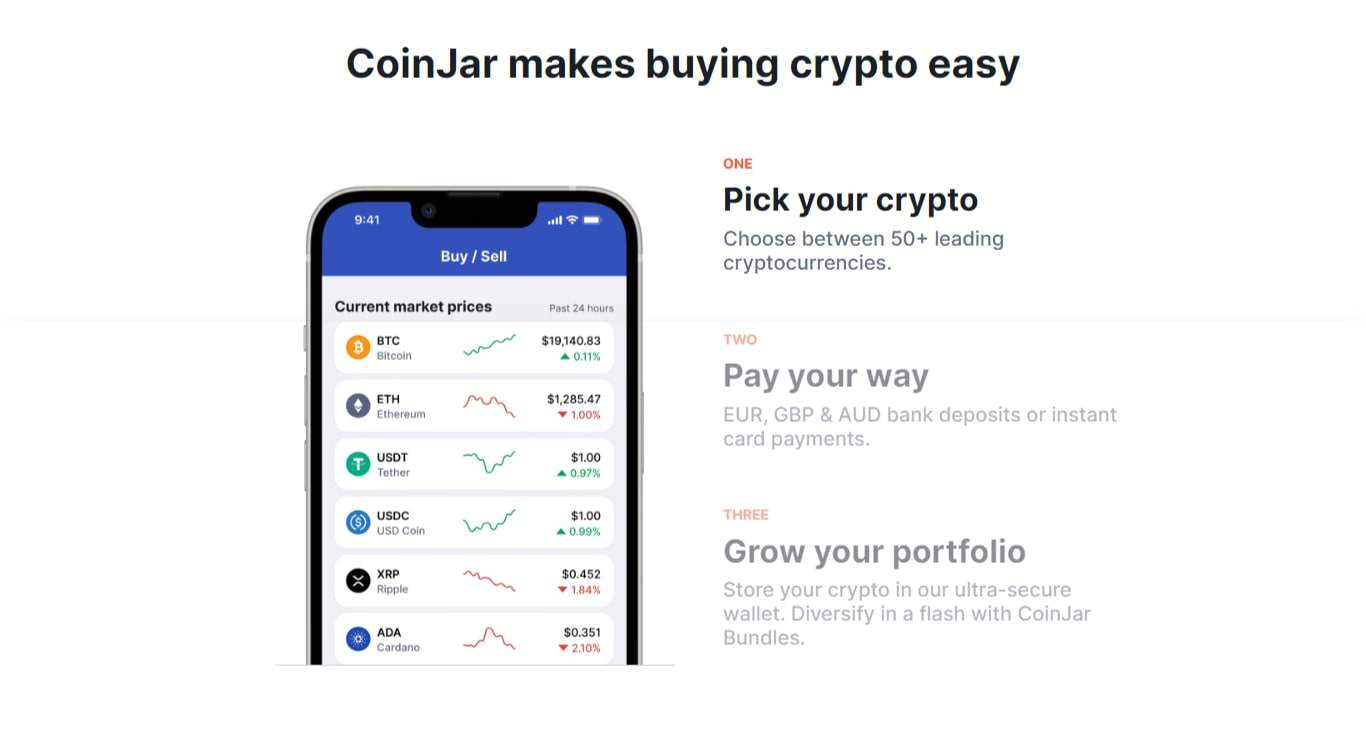

CoinJar, established in 2013, is one of Australia’s oldest Bitcoin exchanges. It prides itself on providing a simple interface designed for ease of use, making it favourable for both novice and experienced investors.

CoinJar’s offering includes a diverse range of digital assets, a dedicated CoinJar Mastercard, and other features aimed at creating a seamless experience for its customers. Over the years, CoinJar has also placed considerable emphasis on security measures to protect its user’s assets. The journey of this pioneering Australian exchange has been marked by a series of strategic developments aimed at enhancing user engagement and broadening the crypto exchange range.

The introduction of a dedicated crypto card allowed for greater spending flexibility of digital assets, reflecting the platform’s commitment to aligning with market demand and the evolving landscape of digital finance. Furthermore, the exchange has been responsive to industry standards, continually updating its service offerings to resonate with both crypto enthusiasts and long-term investors.

CoinJar Pros & Cons

Pros

Cons

About CoinSpot Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

CoinSpot, launched in 2013 as well, is another leading Australian crypto trading platform, accredited as a Blockchain Australia Certified Digital Currency Business. CoinSpot emphasises providing a user-friendly platform with a vast array of digital currencies for trading.

The exchange boasts features like instant market orders with a clear fee on market orders, a CoinSpot Mastercard, and a strong commitment to customer support, including a live chat feature. Navigating the competitive space of Australian cryptocurrency exchanges, this platform’s trajectory has been shaped by its focus on diversifying its offerings, catering to both the Australian Super Fund and individual crypto investors. The inclusion of the Coinjar Card, a product designed to bridge the gap between digital and traditional finance, is testament to the exchange’s innovative spirit.

The exchange has also been active in enhancing its intellectual property and ensuring that session timeouts and other security measures keep pace with the best in the industry, thereby solidifying its reputation among Australian users.

CoinSpot Pros & Cons

Pros

Cons

CoinJar vs CoinSpot: Supported Cryptocurrencies

In terms of total cryptocurrencies available, CoinSpot users have access to more cryptocurrencies. CoinJar offers 68 cryptocurrencies whereas CoinSpot supports 441 cryptocurrencies.

For those interested in trading high market cap cryptocurrencies, CoinJar supports 18 of the top 30, compared to CoinSpot which supports 26 of the top 30.

CoinSpot supports a significantly higher number of cryptocurrencies compared to CoinJar. With this in mind, CoinSpot definitely has the edge for people looking to trade a wider range of cryptocurrencies.

CoinJar vs CoinSpot: Fees

| Fee Type | CoinJar Fees | CoinSpot Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | 0% | 0% |

| Deposit Fee (Credit Card/Debit Card) | 2% | 2.58% |

| Trading Fee | 0.02% - 0.10% | 0.10% - 1% |

| Withdrawal Fee (Bank Transfer) | 0% | 0% |

When comparing fees between CoinJar and CoinSpot, it’s essential to note that both platforms strive to offer competitive pricing within the industry. Both have a structure that encompasses fees for various transactions, including trading, deposits, and withdrawals.

While they tend to avoid direct fees on certain deposit methods, they both have fee structures in place for withdrawals and certain trades. They adopt a maker-taker fee model, which incentivises liquidity on the platform by offering lower fees for makers compared to takers. While discussing the fee structures of both exchanges, it’s important to note that they are constructed to be transparent and align with the financial habits of their users.

Each platform has been observed to adjust fees over time in response to trade volume and market dynamics. They have managed to strike a balance between maintaining competitive rates and providing a high level of service to customers.

The implementation of fees is done in such a way as to accommodate a variety of transaction types, thereby offering flexibility and ensuring that the costs associated with trading do not deter a broad spectrum of crypto traders.

CoinJar vs CoinSpot: Security

Security is paramount in the crypto industry, and both CoinJar and CoinSpot take this seriously. CoinJar has implemented bank-like security measures, including regular security code audits and customizable security features like anti-phishing phrases.

CoinSpot also prioritises security, conducting frequent security architecture reviews and ensuring all customer cash funds are stored in trust accounts, much like a bank. Both are AUSTRAC-regulated exchanges, adhering to local regulations to enhance investor trust. Diving deeper into the security aspect, both exchanges exhibit a strong commitment to safeguarding user assets through a combination of technology and policy.

With features like custom withdrawal restrictions and multi-factor authentication, they demonstrate an understanding of the nuanced threats present in the digital finance realm. Additionally, their compliance with Australian regulations reinforces the legitimate operation of their platforms, instilling a level of confidence in users that their funds are handled with the utmost care and professionalism.

CoinJar vs CoinSpot: Ease of use

Ease of use is critical for both novice and seasoned crypto traders. CoinJar boasts a clean and simple interface, which has been well-received in the Apple App Store and Google Play Store, making it accessible to mainstream investors.

CoinSpot also offers a user-friendly experience but goes a step further by providing a live chat support service to assist with any deposit methods complexities or trading queries, reflecting their commitment to excellent customer service. Accessibility and ease of navigation remain pivotal in attracting and retaining users on both platforms. They have each crafted an interface that, while distinct in design, prioritises user comprehension and efficiency.

The incorporation of features such as streamlined crypto buying processes and card functionalities, like the CoinJar Mastercard – Simple interface, reflects a design philosophy that values both aesthetic simplicity and functional depth, catering to the needs of a diverse user base, from novices to advanced traders.

CoinJar vs CoinSpot: Support

Support is an area where CoinSpot stands out, offering a locally-based customer support team that’s accessible via a live chat feature, ensuring that help is readily available. CoinJar also offers customer service, with a focus on a straightforward crypto buying process.

However, CoinSpot’s commitment to assistance from customer service, including a more personal approach with chat service, might be preferable for users seeking more direct support. Customer support is a key differentiator in the exchange landscape. CoinJar and CoinSpot both recognise the importance of timely and effective customer service.

CoinSpot, in particular, emphasises direct engagement through its live chat support, which underscores their dedication to resolving queries promptly. CoinJar, while also priding itself on a straightforward interface and support system, may appeal to those who prefer a more self-directed approach.

The availability and quality of support offered by both exchanges are indicative of their commitment to providing a reassuring presence for their users throughout their crypto trading journey.

CoinJar vs CoinSpot: Features

In terms of features, both CoinJar and CoinSpot offer an impressive suite of services. CoinJar provides a CoinJar Mastercard that integrates seamlessly with their platform, alongside other innovative tools for crypto transactions.

CoinSpot, on the other hand, offers a broader range of advanced transaction types that cater to more experienced traders, including derivative trades and advanced trades. Both platforms include features such as instant purchases and a crypto debit card, albeit with different rewards and benefits. Beyond the basic trading functionalities, both exchanges have curated a suite of additional features that enhance the trading experience.

CoinJar’s integration of physical cards and CoinSpot’s advanced trading options illustrate their respective approaches to offering more than just a spot market for assets like Bitcoin and Ethereum. They ensure that their platforms not only meet the current demands of the market but also provide the tools and services that anticipate the future needs of their customer base, including High-volume traders and those experimenting with a variety of financial instruments.

Final Thoughts

In conclusion, both CoinJar and CoinSpot are robust platforms that cater to the needs of Australian investors looking to trade crypto assets. They each have their unique features and fee structures, which may be more or less attractive depending on the individual’s trading habits and investment decisions.

It’s always recommended that users consider their specific needs and seek financial advice when necessary before starting their investment journey on any platform. Reflecting on the broader context, both exchanges hold significant roles in providing Australians access to cryptocurrencies and contributing to the maturity of the local digital finance ecosystem. They exemplify the dynamic nature of the industry, each with unique strengths and market positions.

Their continual evolution mirrors the fast-paced progression of the industry itself, with the potential to influence future trends and the behaviours of crypto investors. It is this adaptive and forward-looking approach that underpins their success and positions them as integral components of the digital economy.

CoinJar vs CoinSpot: FAQs

CoinSpot, which operates within the Australian market, is a crypto trading platform offering a variety of services and security features for trading digital assets. The platform allows users to make deposits and withdrawals with methods like direct bank transfers, debit cards, and other payment options such as POLi, PayID, BPAY, and cash deposits.

CoinSpot provides access to a range of coins, including popular assets like Bitcoin, Ethereum, Shiba Inu, Bitcoin Cash, Binance Coin, and USD Coin. While specifics on the ownership are not publicly disclosed, it’s known that CoinSpot prides itself on being a major player in the Australian crypto industry and adheres to local regulations, providing secure transactions and storing customer funds with a focus on industry-standard security measures.

Determining whether CoinSpot is the best Australian crypto exchange for a user depends on individual needs and preferences. CoinSpot is known for its user-friendly interface, making it accessible for beginners in the crypto market, while also providing features that experienced investors might seek, such as a wide range of digital currencies and trading pairs.

It offers various deposit methods, including credit and debit cards, and direct bank transfers. CoinSpot emphasizes security, with offerings like custom withdrawal restrictions and anti-phishing measures.

For those seeking a crypto trading platform with a strong presence in the Australian market, CoinSpot is a notable option. However, potential investors should research and consider all aspects, such as trading fees and deposit options, to determine if it aligns with their investment goals and strategies.

In the unlikely event that CoinSpot, or any Australian crypto exchange, shuts down, the impact on users and their assets would depend on a range of factors, including the exchange’s security measures, customer funds’ handling, and the legal circumstances of the shutdown. Typically, exchanges have protocols in place to secure digital assets against unforeseen events.

CoinSpot has emphasized their commitment to security, but users should be aware of the platform’s terms of service regarding asset storage. In any case, it is advisable for users to not use exchanges as long-term stores for their crypto assets and to keep their digital investments in personal wallets where they would have more control.

For further guidance in such scenarios, users might seek legal or financial advice.

In Australia, crypto exchanges, including CoinSpot, are subject to regulatory requirements and may be required to report to the Australian Taxation Office (ATO) to comply with anti-money laundering and counter-terrorism financing (AML/CTF) laws. These regulations are part of Australia’s legal framework to ensure transparency in financial transactions.

Crypto traders should be aware of their tax obligations and may consider consulting with a financial advisor for personalized guidance. Users can also use the platform’s transaction history features to assist with their own reporting requirements.

CoinSpot offers services that include the functionality of a hot wallet, allowing users to store digital currencies on the platform to facilitate quick and easy crypto transactions. Hot wallets are connected to the internet, providing an advantage in terms of accessibility for trading on the crypto market.

However, as is the case with all hot wallets, it is recommended that users also consider additional security measures and the use of cold storage solutions for larger or long-term holdings. CoinSpot has implemented various security measures to protect its customer funds, but users are encouraged to review these features and consider their own security strategies.

To withdraw Australian dollars (AUD) from CoinSpot to your bank account, users need to navigate to the withdrawal section of the platform and request a withdrawal. They can choose from available withdrawal methods such as direct bank transfer or other services.

CoinSpot may have specific withdrawal restrictions and could require users to verify their bank account details for security purposes. It is also important for users to be aware of any potential withdrawal fees and processing times associated with their chosen method.

Additionally, for assistance during the withdrawal process, users can utilize the CoinSpot customer service or Live Chat support.

Coinjar, another Australian crypto trading platform, charges various fees depending on the transactions conducted. These fees can include trading fees for instant buys and sells, as well as fees associated with deposits and withdrawals.

The platform might offer fee-free deposit methods for certain payment methods but may charge for others, such as credit and debit card usage. When making trades, there can be a distinction between maker and taker fees, with the fee structure typically outlined on Coinjar’s website or within their user agreement.

It’s important for users to review the fee schedule and consider these costs when making investment decisions.

CoinSpot may charge fees for withdrawing fiat currency (AUD) to an Australian bank account, but these fees can vary and sometimes withdrawals can be free of charge. For crypto withdrawals, the platform often charges a network fee, which covers the cost of transferring the digital assets from CoinSpot to an external wallet.

This fee varies by cryptocurrency due to the differences in network transaction fees for each coin. Users should consult the CoinSpot fee schedule for the most current information regarding withdrawal fees and consider these costs alongside their investment portfolio and trading volumes when making crypto trades or withdrawals.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.