Alright, so you want to know how to buy some Bitcoin (BTC) in Australia. First things first, a quick crash course on buying crypto in general.

Cryptocurrencies can be bought through Australian crypto exchanges or trading platforms. Once you’ve signed up with one, you can log in, deposit money (AUD) into your account.

And then you can use that money to buy and trade cryptocurrencies like BTC on the crypto exchange. Our favourite exchange is Swyftx, it’s easy to sign up and they have 70+ coins available for you to purchase (including Bitcoin of course).

To buy bitcoin, the first thing you need to do is sign up to a cryptocurrency exchange. This is where you will buy bitcoins and store them for trading and spending. Most crypto exchanges support all payment methods including credit card, debit card and bank transfer for Australian residents.

- Register for an account with Swyftx.

- Enable 2FA (2-factor authentication).

- Verify your account.

- Deposit AUD into your account

- Click the “Trade” link

- Search for “Bitcoin” and click on “Buy”.

- Enter the amount AUD you want to trade for BTC, or how much BTC you want to buy.

- Review the details.

- Click “Buy BTC”

How To Get Started With Swyftx

1. Setup Your Account

As mentioned above, Swyftx is our go-to for trading cryptocurrencies in Australia, definitely if you’re starting out. It’s the most trustworthy exchange available and it makes trading buying, selling and switching coins incredibly easy.

After creating your account the first thing you’ll want to do is SETUP MFA (2-factor authentication, adds an extra step for logging in to your account, very easy to setup), you can find this on your Profile page under “Security”.

2. Verify Your Account

Before you do anything on Swyftx you’ll have to verify your account. It has the fastest verification process we’ve tested so it won’t take long.

Click in the left navigation bar on “Profile” then the “Verification” tab

You’ll have to verify your email, mobile number and identity to begin trading.

You will then have to fill in all of your personal information including documents, don’t be alarmed uploading this information, every exchange requires it. It’s to ensure your safety and make everyone on the platform accountable.

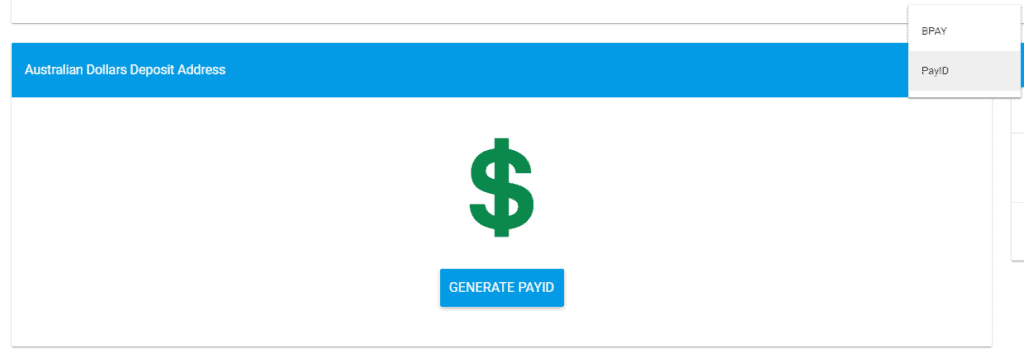

3. Deposit AUD

You’ll first need to deposit AUD on the platform so you can buy an sell cryptocurrency. You can also deposit Bitcoin straight into the platform if you already have some and would prefer trading with that.

Click the left navigation on Deposit AUD

You can then either choose BPAY or PayID to Deposit AUD on the platform.

4. Buy Coins

Once your account is verified and you’ve added AUD or BTC you can start buying and selling cryptocurrency.

Go to Trade

This page lists all the coins that Swyftx has available (which is a lot). You can simply click on any of the cryptocurrencies in the left section under “Assets” or search for your desired cryptocurrency.

Once you’ve decided what you want to buy you can indicate how much AUD you want to buy of each coin.

Easy as that! You now have bought some cryptocurrency. We highly recommend moving your cryptocurrency to a hardware wallet if you are planning on holding it for a while. If you are planning on day trading, or trading fairly regularly we suggest keeping it on the Swyftx platform.

5. Sell Bitcoin

If you have already purchased Bitcoin on another platform then you can easily transfer it to Swyftx and sell it within their platform. From there you can withdraw straight to your bank account.

You can also easily sell it to another cryptocurrency within the platform.

Bitcoin Price AUD

Find the BTC AUD price below:

Bitcoin (BTC)

Where To Buy Bitcoin

We highly suggest using Swyftx to buy and sell Cryptocurrency. We’ve done a comparison of the top 10 exchanges in the world for Australians to use and Swyftx clearly deserves the top spot.

View our full review of the best crypto exchange in Australia.

Swyftx Exchange

Swyftx is by far our most recommended exchange for Australians. They have an easy to use platform and an online wallet that makes trading simple for new users. They have a strong sense of community and are constantly posting updates and adding new coins to their portfolio. On top of this they have low fees and are upfront about any transaction fees they do charge whereas some exchanges charge much more in spreads. This is the most trusted exchange in Australia and arguably one of the best exchanges globally.

How to Pay for Bitcoin Using Different Payment Methods

While Satoshi Nakamoto might have created one of the greatest technological feats of our time, sometimes buying cryptocurrency can be difficult. Luckily, as a result of Bitcoin’s growing popularity, you can choose from a variety of payment options nowadays when purchasing this multipurpose coin. The options include bank transfers, card purchases, paying with cash, using payment processors like PayPal, and even paying anonymously.

Let’s take a closer look at both the advantages and disadvantages of these paying methods before you choose how to buy Bitcoins.

Buying Bitcoin With Your Bank Account

Linking your bank account with your crypto exchange account has never been easier! The most popular Australian exchanges at the moment allow you to make swift and inexpensive bank transfers via the newest payment services.

Swyftx, for example, accepts regular bank transfers that take around 3 to 6 hours to process (only during business days) and automated deposit methods using the following payment processors: POLi, PayID, and Osko.

All three of them offer instantaneous online and mobile transfers that notify the exchange when you make the payment so Swyftx can immediately approve your deposit. POLi payments and PayID are also available on other reliable Australian exchanges like CoinSpot and Independent Reserve. On CoinSpot, you can also choose to make a BPAY transfer with an added 0.9% fee.

After depositing, you can very easily create a buy order in the exchange of your choosing and be the proud owner of some Bitcoin in no time!

If you’re using an international cryptocurrency exchange because it has some cryptocurrency that you otherwise can’t buy on an Australian platform, they typically offer wire transfers or SWIFT payments as a substitute for ACH bank transfers. However, you should be aware that they could take up to one week because both the local and the overseas banks have to approve the transaction.

To speed up the process, you can purchase BTC from an Australian exchange and then trade the coins for your target currency on global crypto exchanges. So no matter if you live in Sydney, Brisbane, Perth, Melbourne… you should be able to find a method that suits you.

Buy Bitcoin With Credit Card in Australia

The option to pay via credit or debit card is available for Australian traders on popular crypto brokers such as Coinbase and Coinmama, but not so much on local exchanges. Even though a lot of traders prefer “paying with plastic”, such practical and time-saving purchases incur higher fees than bank transfers, for example.

Coinbase supports Mastercard and VISA debit card payments with a fixed fee of 3.99% per transaction. This is considered as reasonable pricing worldwide. You just need to create an account, link your debit card, and verify your identity. The only drawback is the purchasing limit of around $7,500 per week for these payments.

In comparison, Coinmama allows both credit and debit card payments but incurs a higher 5.00% “momentum” fee because you purchase Bitcoin at a locked rate and get higher limits on these purchases, i.e. you can buy $5,000 worth of BTC per day or $20,000 per month.

Buy Bitcoin With Cash

Did you know you can withdraw Bitcoin to your wallet address from specialized automated teller machines?

In Australia, there are 18 Bitcoin ATMs (or BATMs) where you can deposit cash (or use your card) to buy Bitcoins. This can also be a lifesaver when you’re traveling abroad and lack Internet access. Just don’t forget to search for a local Bitcoin ATM in advance.

Aussie traders can also buy BTC with cash using a decentralized or peer to peer exchange such as LocalBitcoins by making a cash deposit with Australian dollars. You can browse through the local deals to find sellers that accept cash as a payment method and would agree to meet with you in person. Even though you can check the seller’s reputation and trade history, always arrange to meet somewhere in public.

Finally, Australian exchanges such as CoinSpot and CoinJar offer yet another option for those of you looking to buy BTC with cash at a local newsagent. How does this work? On their website, look for “cash payment” or “blueshyft” in payment methods. Once you enter the BTC amount you want to purchase, the exchange will send a QR code to your email address.

Find the nearest “blueshyft” newsagent and show them your QR code. After they scan your code and verify your order, you can pay with cash and have the BTC transferred to your Bitcoin wallet address.

Buy Bitcoin With PayPal

Another widely used payment method is the American-based online provider PayPal that allows traders to make quick online money transfers. The problem is that not a lot of exchanges support this method because there’s a risk of chargeback fraud. Even when they do, it’s usually quite expensive compared to other methods. Another closely searched method is buying Bitcoin with gift cards, but we don’t recommend either of these methods due to their complexity.

However, if you’re so determined to buy Bitcoin with PayPal, you’re more likely to find this option on peer to peer exchanges like Paxful. You can set the search engine to show PayPal offers exclusively, and find one that works best for you.

Kucoin is one of the few centralized exchanges that support PayPal purchases but only up to $10,000. EToro is another great option if you’re interested in speculating on Bitcoin’s price rather than buying the asset itself.

Finally, if the reason why you want to use PayPal when buying BTC is that you have some money left on your PayPal balance that you need to spend, simply link your PayPal account to a credit or debit card and use this payment method instead.

Buy Bitcoin With Another Crypto

You don’t have to look far if you want to trade some cryptocurrencies you own for Bitcoin. The world’s first digital currency features on every single crypto exchange and can be traded against a plethora of different tokens, both popular and under-the-radar ones.

Many people have bought altcoins such as Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), or Zcash but are looking to trade it for Bitcoin, which is very easy in most popular exchanges.

If you are transferring it from another exchange you’ll simply need to click “Withdraw Bitcoin” and you will get a public key that you can put into the exchange you are moving it to.

For Australian traders, we recommend choosing Binance, one of the most popular trading platforms that both support over 100 cryptocurrencies. Binance has over 450 trading pairs, while Bittrex lists around 300.

Before you get started, double-check that the platform has your trading pair. For example, if you own XRP that you want to trade for BTC, look for a BTC/XRP pair. Next, register for an account, deposit the XRP coins, and buy your Bitcoins by setting the pair and entering the amount you want.

You can create a regular market order to buy BTC at the current market rate or limit order that won’t be executed until the coin reaches the price you’ve set.

Buy Bitcoin Anonymously

Nowadays, centralized crypto exchanges have mandatory KYC (personal details such as name, address, and phone number) checks that newly-registered users have to pass before they’re approved to use their account and trade on the platform. This is done to minimize the risk of cyber thefts and hacking attacks.

Still, there are some ways to avoid identity verification procedures if you believe they do traders more harm than good. After all, Bitcoin was created to promote a higher level of privacy in online Bitcoin transactions and decentralization. So, where can one buy Bitcoin anonymously in Australia?

Apart from some Bitcoin ATMs where you don’t have to provide any documentation to buy Bitcoin, most of them require an ID or ask to take your photo.

One trick is to buy BTC with another digital asset as you can usually complete these trades without verifying your identity. However, if you want to deposit fiat currencies to fund your account, you’ll have to provide some documents for identification first.

You can always try decentralized exchanges such as LocalBitcoins where you sign up using your email address, at least for the time being as the exchange is planning to include mandatory KYC checks soon.

Buying Bitcoin OTC (Over-The-Counter)

All of the above-mentioned options for buying Bitcoin are suitable for small to medium purchases, i.e. under $100,000.

If you’re an institutional investor who doesn’t want to “crash” the market by placing an order for large amounts on regular crypto exchanges and doesn’t trust in the strength of their security features, you should use an over the counter broker with high liquidity to be able to execute your order at once, faster than traditional exchanges ever would.

The most popular over the counter brokers at the moment are Circle, ItBit, and Genesis.

How to Store Bitcoin

Bitcoins are digital currencies with no physical form outside the digital space, so you can’t just purchase them and put them in your regular wallet. You need a suitable digital wallet (a cold storage wallet) that instead of BTC coins stores the encrypted private key that gives you access to your BTC balance.

You’ll find plenty of wallet options online, either on crypto exchanges or third-party providers. However, hardware wallets have a spotless record so far.

The hardware wallet is like a USB stick, easily portable and ultra-secure. It stores your private key offline and, by remaining disconnected from the Internet, this wallet can’t be affected by any malware.

You can look at Ledger Wallet Nano S which supports most cryptocurrencies, has a reasonable price, and Ledger technology to keep it safe; Ledger Wallet Blue, a wallet that runs on the same firmware as Nano S but provides an unsurpassed level of technological security, and Trezor, the first Bitcoin hardware wallet that although a bit dated, fares well for the price.

Furthermore, even if you lose your wallet somehow, you can still get your coins back if you keep the recovery phrase generated during the activation process

Frequently Asked Questions

Is It Legal to Buy Bitcoin in Australia?

Yes. Australia was one of the first countries in the world to recognize the potential of the crypto industry and impose AML (anti-money laundering) policies to regulate it. You can legally buy Bitcoin in Australia since December 2013, when it was marked legal by the governor of the Reserve Bank of Australia (RBA).

In the past, cryptocurrencies were subjected to double taxation in Australia, but in 2017, Bitcoin was recognized as property and is now subjected only to Capital Gains Tax (CGT). As far as mining Bitcoin goes, it’s considered legal as long as you use your own resources, i.e. electricity and computational power.

What is the Best Bitcoin Exchange in Australia?

The best place to buy Bitcoins in Australia is through a cryptocurrency exchange. Nowadays, you have plenty of options to choose from when looking for the ideal Bitcoin marketplace. If you’re a beginner, you would need a fiat-to-crypto gateway to make an AUD deposit. We recommend using Swyftx, as a highly reliable and user-friendly Australian bitcoin exchange. Otherwise, you could also buy Bitcoin by trading it against other cryptos.

Cryptocurrency exchanges in Australia are regulated by the country’s financial intelligence regulator, AUSTRAC, so always check whether the one you choose has obtained a license or not.

How Can I Buy Bitcoins in Australia With Cash?

There are three popular options to buy Bitcoin with cash in Australia. You can use the nearest Bitcoin ATM to deposit funds in cash and withdraw BTC from a liquid broker to your wallet address. Next, you can join a peer to peer exchange such as LocalBitcoins and find a seller who would agree to meet with you in person so that you can pay him/her in cash. Finally, the Australian exchanges CoinSpot and CoinJar offer cash payment known as “blueshyft”.

You get a QR code that you take to a local “blueshyft” newsagent. Once you pay him/her in cash, the exchange transfers the coins you ordered to your account balance.

How Do I Start Trading Bitcoins Using a Cryptocurrency Exchange?

You don’t need to be a crypto expert to start trading Bitcoin using a cryptocurrency exchange. You just need to find an easily-navigable platform suitable for novices. We recommend choosing Swyftx because it’s both beginner-friendly and supports fiat currency to crypto trades.

This way, you can start by depositing Australian Dollars to fund your account and purchase your first BTC without having to convert your native currency into crypto on a third-party exchange and lose time and money in the process.

Is There a Bitcoin ATM in Australia?

Yes! While Coin ATM Radar lists only 18 Bitcoin ATM installations in Australia, FindBitcoinATM shows that this number has doubled to 41 at the moment.

In the past, Bitcoin ATMs could only be spotted in major Australian cities like Sydney and Melbourne, but this has changed in recent years. Today, you can use these machines in 7 additional cities in Australia. This proves that Bitcoin is becoming more and more popular in Australia and that a growing number of retailers are accepting it as a payment method.

How Can I Buy Bitcoins Anonymously in Australia?

Sometimes you’re either in a hurry or lack the right documents to complete an ID verification process to buy BTC. In these cases, you could use a peer to peer exchange where you don’t have to provide any documentation to a central authority, but simply sign up using your email address.

Another option to buy Bitcoin anonymously in Australia is to use a Bitcoin ATM or trade them for another crypto on centralized exchanges. However, if you want to make a fiat deposit, you’ll need to provide an ID.

How Do I Convert Bitcoins to Cash?

It’s true that Bitcoin is widely accepted as a payment method, but it still needs more mainstream adoption to be suitable for everyday purchases. That’s why, for the time being, a lot of traders decide to convert their BTC to cash, and use their value to buy goods.

Most crypto exchanges allow you to withdraw Bitcoin to your bank account, although we suggest you check the withdrawal fees and limits in advance.

How Can I Buy Bitcoins for Cash?

Some traders prefer using cash to buy Bitcoins because it’s fast and convenient. Sadly, there aren’t many places or platforms that allow this. When it comes to crypto exchanges, paying in cash is only possible on peer to peer exchanges if you want a seller who’s willing to accept your offer and meet with you in person. Otherwise, you can try purchasing BTC from a local Bitcoin ATM. Make sure the one you find accepts cash because most of them support card payments only.

How Can I Get Bitcoins Fast?

The fastest way to purchase Bitcoins on crypto exchanges is to pay via credit or debit card. This allows instantaneous payments but incurs some extra costs. Typically, exchanges charge high fees on card payments, ranging from 4-5% per transaction. On top of that, there’s a limit to the amount of Bitcoin you can purchase per cryptocurrency transaction.

How Is Bitcoin Taxed in Australia?

Since 2017, Bitcoin is no longer subjected to double taxation in Australia. This event was hailed as an important win for the Australian crypto market. Today, Bitcoin is subjected only to Capital Gains Tax (CGT). Any capital gain you make when you sell, gift, exchange, trade, or convert your Bitcoins can be partially or fully taxed.

However, if this kind of disposal is part of your business, the profits are taxed as ordinary income. This might have changed as of the time of writing so always check the latest news on the ATO website.