Featured In

Pros

Cons

Quick Summary

| Headquarters Location | Fukuoka, Japan |

|---|---|

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR + 7 others (some through third party apps) |

| Total Supported Cryptocurrencies | 1647+ |

| Trading Fees | 0.25% |

| Deposit Methods | Cryptocurrency, Mercuryo, MoonPay, Transak |

| Support | Twitter, Instagram, Help Center Articles |

| Mobile App | Yes - iOS, Android |

PancakeSwap operates as a decentralized exchange on the Binance Smart Chain, designed to provide an intuitive platform for users to engage in trading activities, participate in staking, and tap into various earning options within the DeFi space. This differs from centralized exchanges, which grant users autonomy over their assets without the oversight of a central authority controlling their funds.

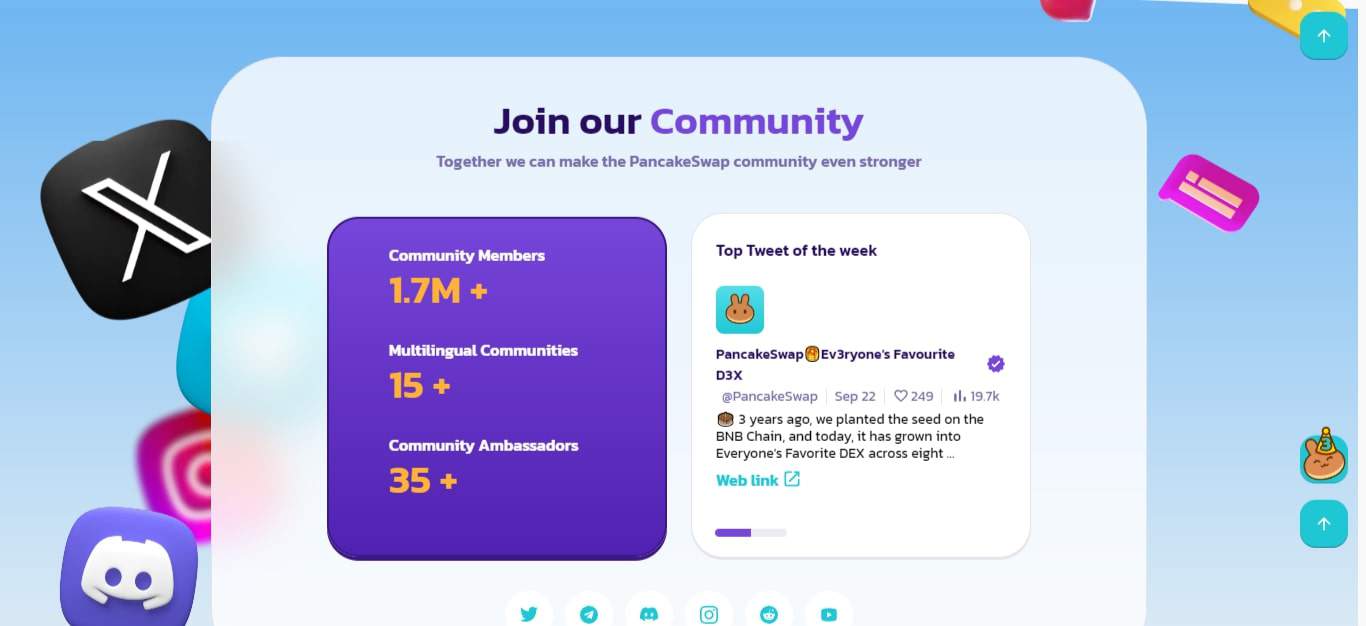

PancakeSwap is set on encouraging more involvement from its community, strengthening its presence on Ethereum and aiming to sustain its ranking based on trading volume, and refraining from creating a proprietary blockchain since it doesn’t correspond with being an all-encompassing multichain DeFi protocol vision.

The strategic plan for PancakeSwap is to roll out new features and improve existing ones. The objective here is to elevate the speed at which transactions are processed while maintaining simplicity and enhancing user-friendliness across the platform.

About PancakeSwap

PancakeSwap emerged in the decentralized finance space in September 2020 thanks to an unknown team of creators. It employs an automated market maker (AMM) system, enabling users to exchange BEP-20 tokens efficiently with low transaction fees.

On PancakeSwap, transactions are direct between users and crypto wallets without creating an account or involving any external parties.

The Core Mechanics of PancakeSwap

As previously mentioned, PancakeSwap utilizes an automated market maker (AMM) system for its operation. This model bypasses traditional buying and selling through an order book. Instead, transactions are made against liquidity pools contributed to by users who add their funds in exchange for liquidity provider (LP) tokens.

This AMM mechanism uses a precise algorithmic formula to balance the pool’s assets according to prevailing market rates. PancakeSwap’s integration with Binance Smart Chain affords its users faster transaction processing when engaging in exchanges involving Binance Smart Chain tokens compared to other decentralized finance platforms.

PancakeSwap has a number of active social profiles including Twitter, Instagram, LinkedIn, Discord, Reddit, Telegram and YouTube.

PancakeSwap Supported Cryptocurrencies

PancakeSwap supports trading on over 1647 cryptocurrencies on their platform. This exchange currently supports 21 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies PancakeSwap supports

- $50

- $BJC

- $DOPE

- $EDDIEM

- $FORWARD

- $GTC

- $LFG

- $MANGA

- $NTDM

- $PNK

- $REKT

- $RICHSHIBA

- $SCROOGE

- $SLC

- $TIME

- $WHALE

- $XBL

- 0DOG

- 0XBTCBR❖

- 0XTRADEAI❖

- 11UP

- 188

- 1ART

- 1DIA

- 1INCH

- 2024

- 2MOON

- 42

- 4DMAPS

- 5SCAPE

- 7TOKI

- AAA

- AAANA

- AARK

- AAVE

- ABK

- ABOND

- ACC

- ACE

- ACH

- ACRIA

- ACT

- ACTN

- ACX

- ADA

- ADI

- ADIS

- ADON

- ADSC

- ADX

- AERO

- AGAT

- AGATA

- AGI

- AGII

- AGO

- AI

- AI314

- AIDUBAI

- AIN

- AIONE

- AIOZ

- AIPAD

- AIQ

- AIRI

- AIT

- AITECH

- AIVIR

- ALEPH

- ALICE

- ALINK

- ALLBI

- ALP

- ALPACA

- ALPHA

- ALT

- ALTC

- ALU

- AMBIENT

- AMC

- AMG

- AMPL

- ANALOS

- ANGEL

- ANI

- ANIMA

- ANIMOCA

- ANKR

- ANKRBNB

- ANKRETH

- ANP

- AOG

- APAW

- APC

- APCOIN

- APE

- APED

- APN

- APNA

- APTS

- APX

- AQUA

- ARABBIT

- ARAPI

- ARBI

- ARCAS

- ARKM

- ARMA

- ARTY

- ASI

- ASIA

- ASN

- ASPO

- ASTRAFER

- ASX

- ATA

- ATC

- ATH

- ATLAS

- ATM

- ATN

- ATNE

- ATOM

- AUCTION

- AUDI

- AURORA

- AURY

- AUSD

- AUTO

- AVA

- AVAX

- AVVP

- AXL

- AXLUSDC

- AXS

- AYBAI

- AZC

- AZM

- AZT

- B3TR

- BABY

- BABYBOME

- BABYBONK

- BABYCAT

- BABYDOGE404

- BABYGROK

- BABYMEME

- BABYMYRO

- BABYRWA

- BABYTOMCAT

- BABYTON

- BABYTROLL

- BAD

- BAI

- BAKE

- BALDC

- BALL

- BAMA

- BANANA

- BAND

- BANK

- BANUS

- BASE

- BAT

- BAYE

- BAYERN

- BB-OWA

- BBANK

- BBB

- BBS

- BBTC

- BCAT

- BCCOIN

- BCFX

- BCH

- BCI

- BCOIN

- BCPI

- BD20

- BDO

- BDPW

- BDXN

- BEAM

- BEARD

- BEE

- BEFE

- BEFI

- BEL

- BELLSKY

- BELT

- BEMD

- BERA

- BESUGO

- BETA

- BETH

- BETS

- BEV

- BFANS

- BFG

- BFOX

- BGS

- BHC

- BIBI

- BIC

- BIDR

- BIFI

- BIGLION

- BIGROO

- BIK

- BILLI

- BIM

- BIN4NCE

- BINANCECAT COIN

- BIOZ

- BIPX

- BITCAT

- BITCOIN

- BITCOINETF

- BITFINITY

- BITSWAP AI

- BLAST

- BLAST2

- BLAZT

- BLK

- BLKC

- BLOCK

- BLOCKLORDS

- BLOK

- BLOX

- BLP

- BLS

- BLT

- BLZ

- BMB

- BMITO

- BMON

- BNBS

- BNBTC

- BNBTIGER

- BNBX

- BNC

- BNG

- BNP

- BNX

- BOB

- BOBA

- BOBO

- BOCZ

- BODEN

- BOMB

- BONK

- BONKGIRL

- BOOST

- BOZZ

- BP

- BPAY

- BPODS

- BPS

- BRACES

- BRASE

- BRC210

- BRG

- BRICS

- BRTR

- BSBOT

- BSCM

- BSCME

- BSCPAD

- BSKT

- BST

- BSTT

- BSW

- BTC.B

- BTC1

- BTCB

- BTCBR

- BTCBSC

- BTCECO

- BTCMT

- BTCP

- BTCPI

- BTCST

- BTCW

- BTCX

- BTC𝕏

- BTECH

- BTG

- BTH

- BTL

- BTNZ

- BTO

- BTR

- BTS

- BTT

- BTTY

- BTYC

- BUNNY

- BURN2.0

- BURN404

- BURNNY

- BUSD

- BVEST

- BVSD

- BVT

- BW

- BWLD

- BXC

- BXEN

- BXNF

- BYBIT

- BYTE

- BYYPLTT

- C98

- CAC

- CACHE

- CAIR

- CAKE

- CAKE-LP

- CANTO

- CAP

- CAPBR

- CAPO

- CAPS

- CARBON

- CARIB

- CASHA

- CAT

- CATBOY

- CATME

- CATNIP

- CATSHIRA

- CC

- CCCLO

- CCDAO

- CCFI

- CCHG

- CCI

- CCID

- CCOIN

- CDN

- CDT

- CDX

- CEEK

- CELL

- CELR

- CFC

- CGG

- CGPT

- CGT

- CGT2.0

- CGV

- CHAIN

- CHAMP

- CHANCER

- CHAPZ

- CHAT

- CHEEZ

- CHER

- CHESS

- CHEX

- CHIIKAWA

- CHOW

- CHR

- CHRP

- CHUCK

- CICN

- CKIO

- CKN

- CKP

- CLEG

- CLICKER

- CLV

- CNNC

- CO

- CODAI

- COINROBOT

- COMBO

- COMP

- COOKIE

- COP

- COPI

- CORGI

- CORX

- COS

- COSA

- COSMIC

- COTI

- COV

- CPC

- CPEEK

- CPGE

- CR7

- CRATX

- CREDI

- CREO

- CRH

- CRICKETS

- CROSSFI

- CRT

- CRTS

- CRWL

- CSIX

- CSN

- CST

- CTC

- CTCB

- CTG

- CTK

- CTSI

- CUC

- CUIN

- CUMMIES

- CWS

- CYBER

- CZGOAT

- CZUSD

- DACKIE

- DAI

- DANCING RAT

- DAO

- DAO9

- DAPF

- DAR

- DARK

- DATA

- DBDT

- DBOE

- DBX

- DC

- DCB

- DCC

- DCK

- DCPTG

- DDTN

- DEBT

- DEC

- DECHAT

- DEFI

- DEGEN

- DEGOV2

- DEMI

- DENCH

- DEPAY

- DESCI

- DESU

- DEWAE

- DEXE

- DEXNET

- DEXT

- DFA

- DFI

- DFY

- DI

- DID

- DIKE

- DINW

- DIO

- DK

- DLB

- DMAIL

- DMOON

- DMTEC

- DNR

- DNT

- DODO

- DOG

- DOGE

- DOGE2.0

- DOGE20

- DOGEGROK

- DOGGY

- DOME

- DOMI

- DON

- DOPE

- DOPX

- DOT

- DPA

- DPR

- DPS

- DRA

- DRAGONFIRE

- DREAM

- DREP

- DRIPX

- DSYNC

- DTC

- DTCN

- DUEL

- DUMPJOE

- DUO

- DUSK

- DVI

- DVT

- DWB

- DYM

- DZHV

- EAGLE

- EARN

- EBC

- EDU

- EFCR

- EFX

- EGLD

- EGO

- EIGEN

- EIGENLAYER

- EKTA V2

- EL

- ELDG

- ELF

- ELF4

- ELON

- ELUNR

- EMP

- ENA

- ENTER

- ENTS

- EOS

- EPIK

- EPK

- EPM

- EPX

- EQB

- ERA

- ERC20

- ERTHA

- ESEUR

- ESHARE

- ESP

- ESRDNT

- ESUSD

- ETC

- ETH

- ETHAI

- ETHFI

- ETHM

- ETHO

- ETH𝕏

- ETK

- EUR

- EURA

- EUSD

- EVLD

- EXIT

- EXO

- EXP

- EXT

- EYE

- EZ

- EZETH

- F3

- FADO

- FAKE-NFT-V3

- FARA

- FAS

- FAV

- FAYA

- FB

- FBT

- FC

- FDS

- FDUSD

- FELIX

- FERMA

- FET

- FETM

- FGD

- FI

- FIL

- FINA

- FINC

- FINE

- FIREPEPE

- FIRO

- FIS

- FIST

- FISTS

- FLAGSHIP BOT AI

- FLOKI

- FLOKITA

- FLT

- FLUX

- FLW

- FLY

- FMB

- FOMO

- FOR

- FORGE

- FOXY

- FPS

- FR

- FRAX

- FRBK

- FREE

- FREEBNK

- FRG

- FRGST

- FRGX

- FRIEND

- FRONT

- FROYO

- FST

- FTC

- FTH

- FTM

- FTNIM

- FTP

- FTR

- FUC

- FUCKSOL

- FUSE

- FXO

- FXS

- G3

- G314

- GAL

- GALA

- GALEON

- GAME

- GBL

- GBTC

- GC

- GCB

- GCR

- GCW

- GEC

- GEN111

- GENI

- GEODE

- GEZY

- GFAL

- GFAM

- GFOX

- GGG

- GGTKN

- GHNY

- GHX

- GIF

- GLG

- GLINK

- GLOT

- GMD

- GMEE

- GMH

- GMI

- GMM

- GMPD

- GMR

- GMRX

- GMT

- GMTC

- GNFT

- GOD

- GOLD

- GOLD ROGER

- GOLDCOİN

- GOMBLE

- GOOD

- GOODLUCK

- GORGONZOLA

- GOV

- GPT

- GPT-1

- GPTP

- GQ

- GRANDPA

- GRAPE

- GRASS

- GRNL

- GROK

- GROW

- GRPTK

- GRT

- GRV

- GSBLC

- GSD

- GST

- GTAI

- GTBOT

- GTC

- GTF

- GULF

- GUPX

- GWGW

- GXT

- GYMNET

- H2ON

- HAI

- HAKA

- HAM

- HAPPY

- HARD

- HASH

- HAY

- HB

- HBX

- HCF

- HCN

- HEAVEN

- HEHE

- HELLO

- HEMULE

- HEPHAESTUS

- HERO

- HFT

- HGPT

- HHEE

- HHT

- HHW

- HHX

- HI

- HICO

- HIGH

- HLF

- HM

- HMA

- HMG

- HMT

- HMTT

- HNBK

- HOGE

- HONOR

- HOOK

- HOR

- HOTCROSS

- HP

- HPLT

- HPXT

- HRCC

- HSBNB_

- HTC

- HTD

- HUAHUA

- HUB3

- HUDL

- HY2CO

- HYDT

- HYME

- HYPC

- HYVE

- HZN

- IAN

- IBTC

- ICE

- ICEMINT

- ICLICK

- ICSW

- ICTN

- ID

- IDIA

- IDK

- IDM

- IDNA

- IDRT

- IGU

- IMPCOIN

- INC

- INFINITY

- INFINITY BURN HTTPS:

- INITIA

- INJ

- INSP

- INSUR

- INTEL

- IO

- IO.NET

- IONET

- IONZ

- IOTA

- IOTX

- IPX

- IRL

- ISP

- IT

- ITC

- ITCC

- IVPAY

- J7C

- JASMY

- JASON

- JAWS

- JEFE

- JEFF

- JEN

- JGT

- JMPT

- JRX

- JSX

- JTI

- KACT

- KAKI

- KARAK

- KARSA

- KAS

- KATA

- KATY

- KBL

- KCN

- KDG

- KDM

- KEL

- KICKS

- KIKA

- KILO

- KIN

- KING

- KINGCAT

- KINGGROK

- KINZA

- KLT

- KLXO

- KMD

- KMNO

- KMON

- KNC

- KOGE

- KOIN

- KOX

- KSC

- KT

- KTC

- KTN

- KUJI

- KUKU

- KUMA

- L1NK

- LABI

- LABS

- LAI

- LAND

- LAZIO

- LB

- LBL

- LBT

- LCN

- LCSN

- LD

- LDA

- LEID

- LENDX

- LEVIANTHAN

- LFT

- LGT

- LICK

- LILI

- LIME

- LINA

- LINEA

- LINK

- LISTA

- LISUSD

- LIT

- LITT

- LIZD

- LKYS

- LMWR

- LNDRR

- LOA

- LOCOS

- LOG

- LOGO

- LOGOS

- LOLLY

- LONG

- LOOP

- LOP

- LOUEY

- LOVE

- LPOP

- LQDX

- LQR

- LSD

- LSDY

- LSR

- LSS

- LTC

- LTCU

- LTO

- LUC

- LUCKYPOOP

- LUNA

- LUSD

- LUZ

- LVL

- M F A 4

- M.F.A 1

- M.F.A 3

- MAIN

- MANA

- MANIA

- MANTA

- MAP

- MAR3

- MARUTI

- MASK

- MAT

- MATH

- MATIC

- MAV

- MB4

- MBOX

- MBX

- MC

- MCAKE

- MCAT

- MCH

- MDLP

- MDT

- ME

- MEGA

- MEME-ETF

- MERL

- MERLIN

- MERT

- META

- METAL

- METAQ

- METAV

- METAWAR

- METIS

- MEVBOT

- MF

- MFTU

- MGD

- MGOOGL

- MGP

- MGT

- MHUNT

- MILO

- MIM

- MIMBO

- MIMIO

- MINGBTC

- MINIPEPE

- MINU

- MIX

- MKR

- MLC

- MLHS

- MLUT

- MM

- MMDW

- MMIT

- MMO

- MMSC

- MNG

- MNST

- MNTO

- MOC

- MON

- MONAD

- MONI

- MONS

- MOR

- MOT

- MP

- MPC

- MRING

- MRXB

- MS

- MSCP

- MSDOGE

- MSS

- MST

- MTC

- MTRG

- MTTM

- MTVT

- MTW

- MU

- MUNK

- MVG

- MVP

- MVS

- MX

- MXBU

- MYR

- MYSHELL

- NABOX

- NAI

- ND

- NEAR

- NETFLIX

- NEXT

- NFDAO

- NFE

- NFEX

- NFP

- NFT

- NFTB

- NFTFN

- NFTS

- NIBI

- NINKY

- NINO

- NMT

- NOP

- NOT

- NOTCOIN

- NOVA

- NSFW

- NSK

- NSPH

- NSWAP

- NTR

- NTX

- NUGS

- NUM

- NUX

- NVT

- NX

- NXNX

- NXUS

- NYAN

- O2

- O2T

- O4DX

- OBOT

- OFN

- OGB

- OK

- OLAND

- OLE

- OLMSV

- OLX

- OM

- OMC

- OMGC

- OMNIA

- OMNUS

- OMP

- ONE

- ONG

- ONI

- ONT

- ONUS

- OPEN

- OPNI

- OPSCC

- OPUL

- ORACLE

- ORAI

- ORCUP

- ORDERLY

- ORDI

- ORFY

- ORN

- ORON

- ORT

- OSAK

- OSEA

- OSK

- OSL

- OVN

- OVR

- OXP

- OZONE

- P

- P2C PRO

- P2PPOWER

- P404

- PACT

- PAID

- PAIR

- PALM

- PAM

- PANDA

- PANDORAG

- PAPA

- PARALLEL

- PARAM

- PARCL

- PARK

- PARMY

- PARTICLE

- PATEX

- PATS

- PAX

- PAYC

- PAYU

- PBTC

- PBX

- PCAT

- PCC

- PEEL

- PEL

- PENCIL NECK

- PENDLE

- PEOPLE

- PEPE

- PEPE2.0

- PEPEAI

- PEPECHAIN

- PEPEGPT

- PEPEP

- PERENNIAL

- PERL

- PERP

- PERRY

- PFB

- PGPT

- PGS

- PGSK

- PHA

- PHB

- PHDAO

- PHT

- PIG

- PINO

- PINU

- PIPI

- PIRATE

- PIXFI

- PJB

- PKR

- PLANET

- PLAY

- PMON

- PMP

- PMT

- PNDR

- PNIC

- PNP

- PNS

- PNT

- POKO

- POLS

- POOLX

- POP

- PORT3

- PORTAL

- PORTO

- POWER

- PPAY

- PPCB

- PPRO

- PRIMAL

- PRIME

- PRIVASEA

- PRLMNT

- PRODUS

- PROS

- PRQ

- PRT

- PSTAKE

- PTC

- PUFFER

- PUMP

- PURSE

- PV3

- PV3L1

- PVC

- PVU

- PWAR

- PXETH

- PZP

- Q-GOLD

- QANX

- QFS

- QK9

- QKC

- QLAND

- QORPO

- QTS

- QTXAI

- QUACK

- QUANTA

- QUSA

- QWLA

- RACA

- RADAR

- RAINI

- RAMP

- RAVEN

- RAZE

- RBLZ

- RBNB

- RCADE

- RCC

- RDNT

- RDRT

- RDT

- RECQ

- REDEX

- REEF

- REIS

- RENZO

- REOS

- RETA

- REUNI

- REVA

- REVV

- RGAME

- RGDC

- RGEN

- RICB

- RICK

- RIO

- RITE

- RITZ

- RJV

- RMN

- RNDR

- ROAR

- ROB

- ROCK

- ROCKI

- ROD

- RON

- ROOBEE

- ROOSTER

- ROSE

- RPG

- RPT

- RPTR

- RSTAR

- RUG

- RUN

- RUPEE

- RVF

- RWC

- RWT

- RWX

- RX1

- RXCG

- RYZE

- SABLE

- SAFE

- SAGA

- SAITO

- SAM

- SAN

- SAND

- SANTOS

- SAT1000

- SATA

- SATOZ

- SATS

- SAUDI ARABIA

- SAX

- SBT

- SBTX

- SCAR

- SCE

- SCLP

- SCORP

- SCOTTY

- SCPT

- SDA

- SDAO

- SDCAKE

- SEAH

- SEED

- SEEDZ

- SEILOR

- SELF

- SEN

- SERSH

- SEXDAO

- SFG

- SFP

- SFUND

- SGP

- SGZ

- SHAH

- SHARK

- SHARKOIN

- SHGD

- SHIB

- SHIBB

- SHIELD

- SHIKO

- SHILL

- SHIT

- SHO

- SHOKI

- SHRAP

- SIOE

- SIR

- SIS

- SISC

- SIZ

- SKO

- SKYFI

- SL

- SLACK

- SLAFAC

- SLISBNB

- SLM

- SLP

- SMCW

- SMDX

- SMILEY

- SMOG

- SMU

- SNAKE

- SNFTS

- SNG

- SNIP

- SNM

- SNS

- SNX

- SOCA

- SOL

- SOL BURN

- SOLAR

- SOLDOGE

- SON

- SOPH

- SPAC

- SPACE

- SPACEPI

- SPARTA

- SPAWN

- SPAY

- SPE

- SPELLFIRE

- SPHYNX

- SPIN

- SPL

- SPONGEV2

- SPS

- SPSR

- SPT

- SQR

- SQUAD

- SQUID

- SRG

- SRP

- SSC

- SSKY

- SSNC

- SSZ

- STA

- STABLE

- STAR

- STARRYNIFT

- STC

- STE

- STG

- STK

- STKBNB

- STONE

- STR

- STREAM

- STRG

- STRKAI

- STRX

- STV

- STX

- SUKIW

- SUPER

- SUPERATM

- SUPRA

- SUSHI

- SUTER

- SUXUS

- SVN

- SWCT

- SWFTC

- SWM

- SWP

- SXP

- SYN

- SYNTH

- T1

- T369

- TABI

- TADA

- TAN

- TAP

- TAROT

- TAX3

- TBC

- TBCC

- TBT

- TCLUB

- TCN

- TCP

- TECAR

- TED

- TEDX

- TEM

- TESLA

- TEX

- TFS

- TFT

- TFX

- THE

- THG

- TIC

- TIKT

- TIME

- TINC

- TINY

- TKC

- TKING

- TKO

- TKP

- TLC

- TLM

- TLOS

- TMT

- TNR

- TNSR

- TOKEN

- TOKEN2049

- TONCOIN

- TOWER

- TPAD

- TPING

- TPT

- TRADE

- TRAVA

- TRC

- TRIAS

- TRIT

- TROLL

- TROLLMP

- TRS

- TRU

- TRUMP

- TRUMPARMY

- TRUMPBUCKS

- TRUNK

- TRUSTK

- TRVL

- TRX

- TRY

- TS

- TST

- TSTS

- TT

- TTC

- TTM

- TTX

- TUSD

- TWG

- TWT

- TX20

- TXG

- TXL

- TXOF

- UBX

- UBXN

- UCOS

- UEDC

- UFC

- UFT

- UGSC

- UIBT

- ULAM

- ULTC

- ULX

- UMB

- UMP

- UNA.WEMIX

- UNB

- UNC

- UNCL

- UNFI

- UNI

- UNISAT

- UNIX

- UNO

- UNSHETH

- UNW

- UPFI

- UPR

- US-PAY

- USA

- USDC

- USDE

- USDFI

- USDQ

- USDT

- USDV

- USDZ

- USH

- UST

- UTLHOME

- VAI

- VALIUM

- VC

- VELAR

- VELO

- VENOM

- VENT

- VET

- VIA

- VINU

- VITE

- VLX

- VNDC

- VOLMEX

- VOLT

- VOLTZ

- VOP1

- VOPO

- VOT3

- VPAD

- VPP

- VPR

- VRL

- VRT

- VT

- W8BIT

- WAGMI

- WAGMIGAMES

- WAIFU

- WALTER

- WALV

- WAM

- WAMO

- WARDEN

- WAVAX

- WBAN

- WBENG

- WBETH

- WBGL

- WBNB

- WBT

- WBTC

- WBTCZ

- WBYTZ

- WCC

- WCHK

- WDASH

- WDINGOCOIN

- WDLY

- WDRIP

- WDZOO

- WE

- WEC

- WECO

- WEFT

- WEGC

- WEJS

- WER

- WETH

- WFTM

- WHEN

- WHITE

- WHRH

- WHY

- WIF

- WIN

- WIXI

- WLC

- WLKN

- WMATIC

- WMN

- WMT

- WMX

- WNCG

- WOD

- WOL

- WOLVES

- WOM

- WOO

- WOOP

- WOR

- WORK

- WPI

- WPKT

- WPLQ

- WPLS

- WPROSUS

- WRD

- WROSE

- WRTM

- WRUB

- WRUSD

- WRX

- WSAC

- WSG

- WSH

- WSI

- WSWIFT

- WTAL

- WTC

- WTH

- WTROLL

- WTRP

- WWY

- X

- X314

- XALGO

- XBA

- XCAD

- XCB

- XCCX

- XCL

- XCN

- XEC

- XED

- XEP

- XLD

- XLM

- XPE

- XPNET

- XPR

- XRGB

- XRP

- XRP589

- XRPCL

- XSHIBA

- XSRS

- XT99

- XTERIO

- XTM

- XTO

- XTZ

- XVS

- XWG

- XYZ

- YABOTEST

- YABTEST

- YES

- YFI

- YFII

- YON

- YOURAI

- YUKLA

- ZAI

- ZAM

- ZAMA

- ZBC

- ZCRAI

- ZEC

- ZEDXION

- ZENDZ

- ZENF

- ZEPX

- ZETA

- ZEUS

- ZHI

- ZIG

- ZIL

- ZILLA

- ZIN

- ZK

- ZRO

- 中国龙

- 🌒ECLIPSE🌘

- 👱🏼TRUMP👱🏼

Trading Experience

PancakeSwap’s appeal lies significantly in its user-friendly design. Once a compatible crypto wallet is set up, users can dive into trading immediately without the requirement for account creation. Traders can maneuver through an efficiently organized interface with clear and accessible menus.

Users can also engage in various activities, including yield farming, token exchange, and lottery participation. These attributes allow for swift familiarization and optimal utilization of what PancakeSwap offers.

Engaging in crypto trading on PancakeSwap is designed to be straightforward. To initiate trades, follow these steps:

- Navigate to the platform’s official site.

- Hit ‘Trade’

- Sync your wallet with the platform.

- Pick your preferred cryptocurrency.

- Confirm you have chosen the correct tokens for trade

- Execute the transaction

Following this process allows you to start exchanging tokens on PancakeSwap quickly.

PancakeSwap Fees

PancakeSwap sets itself apart from its competitors in the fee department. Its use of the Binance Smart Chain enables it to offer lower trading fees, as this chain experiences less congestion than Ethereum’s network used by platforms such as Uniswap. The lowered Pancakeswap withdrawal fees lead not only to more cost-effective transactions but also to faster execution times.

For each swap transaction, PancakeSwap levies a modest 0.25% charge, part of which is rewarded to liquidity providers on the platform. Other services, like Uniswap, impose higher fees that benefit liquidity providers exclusively.

Such an advantageous pricing model regarding trading and withdrawal fees positions PancakeSwap favorably among users looking for profitable opportunities through staking or lending activities while considering overall costs, including those tied to withdrawals from PancakeSwap.

| Type | Fee |

|---|---|

| Trading Fee | 0.25% |

Security - Is PancakeSwap Safe?

PancakeSwap prioritizes safety and, as such, frequently commissions independent entities like CertiK and Slowmist to conduct thorough security audits. These audits ensure that PancakeSwap’s defensive protocols are both current and potent.

Nevertheless, users should be aware of inherent hazards associated with any decentralized service, which include:

- Exploits within intelligent contract code

- Phishing schemes designed to deceive

- Compromises through malicious software or unauthorized access attempts

- Potential for transient depletion of funds within liquidity pools

It is crucial to remain well-informed and take appropriate protective measures to safeguard your investments in PancakeSwap or similar decentralized services.

PancakeSwap Customer Support

While PancakeSwap is a decentralized platform, it strongly focuses on user support. Its help section is organized into distinct topics for efficient problem-solving. Users can easily navigate the Troubleshooting Errors and General FAQ sections to assist with frequent issues or general inquiries.

The platform also provides multiple guides that tackle technical difficulties frequently encountered by users.

PancakeSwap Support Channels

Liquidity Provision and Earning Opportunities

PancakeSwap offers multiple methods for users to create passive income streams. Users can engage in providing liquidity by:

- Supplying assets to liquidity pools collects trading fees from others who utilize these pools.

- Reinforcing the worth of their LP (Liquidity Provider) tokens through reinvestments of accumulated rewards into the pool.

- Gaining APRs is influenced by the amount held within a pool and its overall makeup.

Alternatively, yield farming presents an opportunity for earnings on PancakeSwap. This approach requires staking your LP tokens inside designated farms after contributing pairs of different tokens. The specific farm chosen will have a set multiplier that decides your CAKE reward rate per block produced, which varies between each farm.

Initial Farm Offerings (IFOs) present yet another earning mechanism on PancakeSwap. IFOs enable new projects to be introduced onto the platform, allowing them to distribute their newly minted tokens directly to those participating in yield farming activities.

Community Governance on PancakeSwap

PancakeSwap is committed to its principles of decentralization by fostering community governance. Holders of the CAKE token are empowered with voting privileges that allow them to weigh in on critical decisions within the platform via a structured polling system.

Community members can submit proposals, but only PancakeSwap Core Team members may address critical protocol subjects.

Understanding PancakeSwap’s Native Token

At the heart of the PancakeSwap exchange is the CAKE token called a BEP-20. The role of CAKE extends across several functions on this platform, including but not limited to:

- Acting as a governance vehicle

- Being used for staking purposes

- Enabling users to enter lotteries

- Functioning as a form of payment

The incentive structure for staking within PancakeSwap includes multiple benefits, such as the following:

- Earn variable Annual Percentage Rates (APR) in CAKE tokens when you commit your funds to their dedicated staking pools.

- Benefit from a deflationary strategy applied to CAKE that involves periodic token burn events and decreasing emission rates.

- Access decision-making processes by holding CAKE tokens, which reflect your voting power.

- Engage in pivotal discussions concerning matters like adjustments in CAKE emissions, protocol amendments, or how multi-chain war chests are utilized.

Using PancakeSwap on Mobile

PancakeSwap is fully functional on mobile devices, allowing users to engage with the platform through various compatible wallets, including Trust Wallet, Coinbase Wallet, SafePal, and Token Pocket.

Connecting to PancakeSwap via Trust Wallet is effortless; users press the DApps button and choose from either the Popular or Exchanges categories.

For those using iOS, connecting with PancakeSwap requires WalletConnect due to certain platform constraints. Individuals who prefer MetaMask on their mobiles must manually incorporate the BNB Smart Chain network into their wallet configurations.

How to Sign Up on PancakeSwap

- Create Account - Visit the PancakeSwap website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the deposit methods listed below, some of which are third party apps.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

PancakeSwap Alternatives

1inch

Total Supported Cryptocurrencies

267+

Trading Fees

0%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 10 others

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Bancor Network

Total Supported Cryptocurrencies

239+

Trading Fees

0.1%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 70 others

Final Thoughts

PancakeSwap stands out in the decentralized finance arena due to its intuitive interface, competitive fees, stringent security protocols, and exceptional customer support. The platform entices users by providing various services, including a unique NFT marketplace, the ability to make cross-chain token swaps and engaging gaming features.

PancakeSwap consistently leads DeFi in innovation. It remains committed to improving user experiences by adopting cutting-edge technologies and broadening its presence across various blockchain ecosystems.

For those involved in trading, yield farming, or newcomers curious about DeFi’s offerings, PancakeSwap presents a secure and accessible platform to trade tokens that comprehensively serves diverse needs.

PancakeSwap FAQs

PancakeSwap, like any decentralized exchange, carries inherent risks associated with smart contract vulnerabilities, user error, and market volatility. It’s essential to conduct due diligence and consider the security measures in place, such as audits by reputable firms, which PancakeSwap has undergone.

However, no platform can be considered completely risk-free, so users should always proceed with caution.

PancakeSwap generates revenue primarily through trading fees. Users who trade tokens on the exchange are charged a small fee, a portion of which is distributed to liquidity providers as a reward for supplying liquidity to the pools.

Whether Uniswap or PancakeSwap is better for an individual depends on their specific needs and preferences. Uniswap operates on the Ethereum blockchain and may provide a wider variety of tokens, while PancakeSwap, built on the Binance Smart Chain, often offers lower transaction fees.

The decision between the two would depend on factors such as preferred blockchain, fee structure, and available liquidity pools.

If PancakeSwap isn’t working on your Trust Wallet, it could be due to several reasons, such as network congestion, an outdated app, or incorrect wallet configuration. Ensure you’re using the latest version of Trust Wallet, have selected the correct network, and that you have enough BNB for transaction fees.

PancakeSwap is a decentralized exchange (DEX) that allows users to swap BEP-20 tokens without the need for an intermediary. To use it, you’ll need a compatible crypto wallet, connect it to PancakeSwap, and then you can trade tokens, provide liquidity to pools, and participate in farming and lotteries, among other features.

PancakeSwap works using an automated market maker (AMM) model where liquidity pools are used to facilitate trades. Users can swap tokens, provide liquidity to earn rewards, and participate in other platform activities.

Prices are determined by the supply and demand dynamics of the liquidity pools rather than an order book like traditional exchanges.

PancakeSwap is not a US company; it is a decentralized exchange running on the Binance Smart Chain. Decentralized exchanges don’t have a central authority or a headquarters and are instead governed by smart contracts and community governance.

Whether PancakeSwap is good depends on what you’re looking for in a decentralized exchange. It offers a user-friendly interface, various features such as yield farming and lotteries, and has a large user base, which contributes to its liquidity.

Always assess its suitability for your needs and consider the general risks associated with using decentralized finance platforms.

PancakeSwap User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for PancakeSwap - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.

Best Cryptocurrency Exchange for Altcoins

Best Cryptocurrency Exchange for Altcoins Best Anonymous Cryptocurrency Exchange

Best Anonymous Cryptocurrency Exchange