Pros

Cons

Quick Summary

| Headquarters Location | International |

|---|---|

| Fiat Currencies Supported (through third party apps) | USD, AUD, GBP, CAD, EUR, NZD + 70 others |

| Total Supported Cryptocurrencies | 289+ |

| Trading Fees | 0.30% |

| Deposit Methods | Cryptocurrency, Transak |

| Support | Twitter, Help Center Articles, Support Ticket |

| Mobile App | Has no mobile app. |

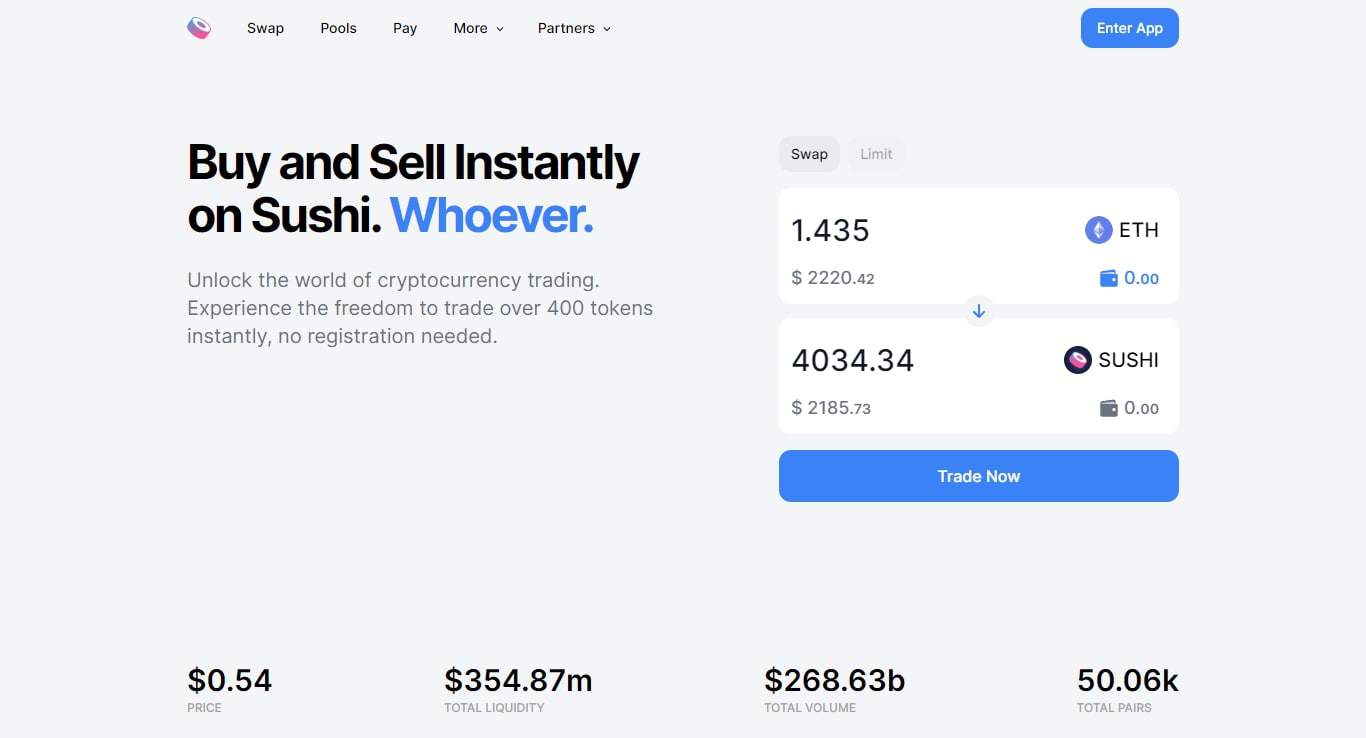

Welcome to our comprehensive review of SushiSwap, an innovative player in the decentralized finance (DeFi) landscape. This platform has been making waves since its inception, offering a unique approach to cryptocurrency trading and liquidity provision.

While SushiSwap serves as a beacon of innovation within the sphere of Decentralised Finance (DeFi), its inception was as much about timing as it was about technology. Emerging amidst a surging interest in DeFi solutions, SushiSwap tapped into a market eager for alternatives to traditional finance.

It sought to blend the best elements of its predecessors with its own fresh twists, appealing to a diverse user base from hardcore crypto investors to casual enthusiasts seeking to explore the burgeoning realm of digital assets. The platform’s growth is a testament to the evolving landscape of finance, where decentralised exchanges are no longer just an alternative but a mainstay for a growing number of users.

About SushiSwap

SushiSwap started as a fork of the prominent decentralized exchange Uniswap, but it has since carved out its own identity with distinctive features and a strong community backing. The platform was launched by an anonymous developer known as Chef Nomi, and it quickly gained traction for its community-oriented ethos and additional reward mechanisms.

Its foundation lies in allowing users to trade, swap, and add liquidity across a range of Ethereum-based tokens in a completely decentralized manner.

SushiSwap’s narrative is interwoven with significant moments in the history of DeFi. Not long after its launch, it became the centre of attention due to a dramatic event involving Chef Nomi, the anonymous founder, who withdrew a substantial sum of funds from the developer fund.

This incident provoked intense community discourse on trust and governance in the DeFi space. However, the project’s resilience was showcased in its recovery and commitment to transparency moving forward.

This event highlighted the importance of community governance and the potential perils of decentralised networks, shaping how SushiSwap and similar platforms approach developer funds and protocol management.

SushiSwap has a number of active social profiles including Twitter, LinkedIn, Discord, Reddit and YouTube.

SushiSwap Supported Cryptocurrencies

SushiSwap supports trading on over 289 cryptocurrencies on their platform. This exchange currently supports 8 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies SushiSwap supports

- $GENE

- $MAID

- 1INCH

- AAVE

- ADX

- AERGO

- AGLD

- AKRO

- ALCX

- ALEPH

- ALPHA

- AMP

- AMPL

- ANGLE

- ANKR

- ANT

- APE

- API3

- APW

- ARA

- ARMOR

- AUCTION

- AVASTR

- AXS

- BAD

- BADGER

- BAND

- BANK

- BAO

- BASE

- BBADGER

- BCMC

- BENJI

- BFC

- BGAN

- BICO

- BIFI

- BIT

- BITT

- BLOCKS

- BLUR

- BMI

- BOND

- BONDLY

- BOR

- BPT

- BTC

- BTC2X-FLI

- C98

- CEL

- CIG

- CLNY

- COMP

- COTI

- CQT

- CREAM

- CRU

- CRV

- CVP

- CVX

- CVXCRV

- DACXI

- DAI

- DAO

- DATA

- DAWN

- DDX

- DELTA

- DERI

- DEXTF

- DFX

- DG

- DIA

- DIGG

- DMT

- DNT

- DOG

- DOGEGF

- DOLA

- DOSE

- DPI

- DPX

- DRGN

- DUCK

- EDEN

- EETH

- ENS

- ENTR

- EROWAN

- ETHDYDX

- EURA

- FARM

- FNC

- FODL

- FOLD

- FOUR

- FRAX

- FRONT

- FTT

- FXS

- GALA

- GAS

- GCAKE

- GET

- GLM

- GODS

- GOG

- GOVI

- GRT

- HEGIC

- HOP

- IBBTC

- ICE

- ICHI

- ID

- IDLE

- ILV

- IMX

- INDEX

- INJ

- INSUR

- INV

- IQ

- ITP

- JPEG

- KIRA

- KP3R

- LDO

- LEND

- LINA

- LINK

- LON

- LUSD

- LYM

- LYRA

- MANA

- MARS4

- MASK

- MASQ

- MATIC

- MBBT

- MEEB

- METIS

- MEZZ

- MILADY

- MIM

- MIR

- MKR

- MLN

- MODA

- MOONCAT

- MOVE

- MPH

- MTA

- MULTI

- NAOS

- NDX

- NEWO

- NFD

- NFTL

- NFTX

- NII

- NST

- NU

- OCEAN

- OG

- OHM

- OMG

- OMNI

- ONEBTC

- ONX

- OOKI

- OPIUM

- OS

- PAD

- PENDLE

- PERC

- PERP

- PHTR

- PHUNK

- PICKLE

- PIPT

- PLBT

- PLR

- PMON

- PNK

- POLY

- POND

- POOL

- POWR

- PREMIA

- PRIMATE

- PROS

- PSP

- PUNK

- QTO

- QUARTZ

- QUIDD

- RADAR

- RAIL

- RARE

- RARI

- RAZOR

- REN

- RENBTC

- REVV

- RGT

- RLC

- ROBO

- ROOK

- RUNE

- SATA

- SDT

- SFI

- SGTV2

- SHIB

- SHOPX

- SHPING

- SI

- SLP

- SNOOP

- SNX

- SOKU

- SOS

- SPELL

- SQGL

- SRM

- STAKE

- STANDARD

- STATE

- STND

- SUKU

- SUPER

- SUSD

- SUSHI

- SYN

- TCAP

- TCR

- THOR

- TOKE

- TORN

- TOWER

- TRAC

- TRU

- TUSD

- UFT

- UMA

- UMB

- UNI

- UNQT

- USDC

- USDT

- USH

- UST

- USTC

- USV

- UWU

- VEGA

- VSP

- WALLET

- WBTC

- WDOGE

- WETH

- WFIL

- WFLOW

- WFTM

- WHALE

- WIZARD

- WKDA

- WNCG

- WOO

- WSTETH

- WTLOS

- WXRP

- X

- XAI

- XDEFI

- XFT

- XRUNE

- XSUSHI

- XYZ

- YAM

- YEL

- YFI

- YGG

- YLD

- YVBOOST

- YVE-CRVDAO...

- ZRX

Trading Experience

The trading experience on SushiSwap is tailored to cater to both novice and seasoned traders. The platform’s interface is intuitive, allowing users to seamlessly navigate through various trading pairs and liquidity pools.

With features like the Onsen Menu, traders can explore a variety of incentivised pools, potentially enhancing their trading strategy. Further, SushiSwap’s integration with the wider Ethereum-based DeFi ecosystem allows for a breadth of trading options and asset accessibility.

Trading on SushiSwap is an exercise in efficiency and variety, catering to a broad spectrum of trading strategies. The platform’s innovative Onsen Menu presents users with a curated selection of incentivised liquidity pools, fostering an environment where traders can optimise their yield and engage with a diverse array of digital assets.

The continuous integration of new features and compatibility with Layer-2 solutions reflects SushiSwap’s commitment to streamlining the trading experience while minimising network fees and facilitating rapid token swaps.

SushiSwap Fees

Navigating the fee structure of SushiSwap need not be a headache. The platform employs a fee model designed to reward participants while ensuring the sustainability of the exchange.

Traders are charged a fee on transactions, a portion of which is allocated to liquidity providers as a reward for their contribution to the liquidity pools. The fee model is crafted to balance the interests of traders, liquidity providers, and the broader SushiSwap ecosystem.

The intricacies of SushiSwap’s fee system reflect a greater ambition to cultivate an ecosystem where all participants can derive value. By calibrating the transaction fees to incentivise liquidity providers without deterring traders, the platform has struck a balance that benefits the network as a whole.

This approach underscores a broader shift within decentralized markets, where the value exchange between users and protocols is constantly being refined to foster sustainable growth and incentivise the provision of liquidity to pools.

| Type | Fee |

|---|---|

| Trading Fee | 0.30% |

Security - Is SushiSwap Safe?

Security on SushiSwap is fortified by its decentralized architecture, smart contracts, and transparent operations. As a platform built on the Ethereum network, it inherits the robust security measures inherent to blockchain technology.

Additionally, the protocol has been designed to minimise central points of failure, with liquidity providers and SUSHI token holders playing a significant role in governance decisions, further distributing power within the network.

Security on SushiSwap extends beyond its foundational decentralized network, as it incorporates cutting-edge features like multi-sig wallets and automated market maker protocols. These measures are not only technical but also procedural, ensuring that decision-making power is distributed and that operations are subject to community oversight.

The integration of open-source smart contracts provides transparency and auditability, which bolsters trust among users. These efforts are pivotal in safeguarding funds and sustaining confidence in decentralized cryptocurrency exchanges.

SushiSwap Customer Support

SushiSwap’s customer support team is a testament to its community-centric approach. While decentralized exchanges generally do not offer the same level of customer service as centralized counterparts, SushiSwap provides support through multiple channels, including community forums and social media, where users can seek assistance and share insights with one another.

In the ecosystem of SushiSwap, the customer support team is a vital link between the platform and its users. Their role transcends traditional support services, embracing the ethos of decentralised finance by empowering users through education and community engagement.

This enables users to navigate the complexities of the DeFi space more confidently, fostering a sense of solidarity and shared purpose within the SushiSwap community.

SushiSwap Support Channels

How to Sign Up on SushiSwap

- Create Account - Visit the SushiSwap website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the methods listed below. Remember this exchange only supports depositing fiat currencies through third party apps it supports.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

SushiSwap Alternatives

1inch

Total Supported Cryptocurrencies

267+

Trading Fees

0%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 10 others

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Bancor

Total Supported Cryptocurrencies

239+

Trading Fees

0.1%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 70 others

Final Thoughts

Reflecting on SushiSwap, it’s evident that the platform has positioned itself as a notable contender in the realm of decentralized exchanges. With its unique incentives for users and commitment to community governance, SushiSwap has captured the interest of many in the DeFi space.

The trajectory of SushiSwap mirrors general trends within the crypto exchange realm, where decentralisation, community governance, and user incentivisation form the cornerstones of a new financial paradigm. Crypto exchanges have evolved to become more than mere trading platforms; they are now hubs of financial innovation, shaping the future of how we perceive and interact with assets, currency, and investments.

As the market matures, the role of these platforms in establishing future infrastructure for digital finance will likely expand, and their influence on economic potential cannot be understated.

SushiSwap FAQs

Determining whether SushiSwap is better than Uniswap depends on individual preferences and needs. Both are decentralized cryptocurrency exchanges built on the Ethereum network, providing users with the ability to swap a variety of Ethereum-based tokens.

SushiSwap originated as a fork of Uniswap and introduced the SUSHI token to incentivize liquidity providers with additional rewards. Each platform has its unique features, community governance structure, and liquidity pools.

Users may prioritize different aspects such as the specific rewards offered, the user interface, or the community involvement. It’s essential to research and compare their offerings based on the latest developments from both protocols before deciding which aligns better with one’s trading strategy and goals.

Yes, SushiSwap is built on the Ethereum blockchain. It is a decentralized exchange that utilizes Ethereum’s smart contract capabilities to facilitate token swaps, liquidity provision, and yield farming.

SushiSwap allows users to trade ERC-20 tokens and provide liquidity to pools, earning rewards in the form of SUSHI tokens. As a participant in the decentralized finance (DeFi) ecosystem, it operates without a central authority, and transactions are executed through self-executing smart contracts on the Ethereum network.

SushiSwap is primarily on the Ethereum blockchain, which is a fully-decentralized L1 blockchain. It’s an automated market maker (AMM) that enables swaps for Ethereum-based tokens and provides infrastructure for users to become liquidity providers within its liquidity pools.

The SUSHI token is central to its ecosystem, incentivizing participation and giving SUSHI token holders governance power over community decisions. Additionally, SushiSwap may also be deployed on other EVM-compatible Layer-2 and blockchain networks to optimize for lower transaction fees and faster confirmation times.

SushiSwap forked from Uniswap in August 2020, primarily to introduce the SUSHI token, which added an incentive mechanism for liquidity providers. The fork was initiated by the anonymous developer known as Chef Nomi, and it aimed to differentiate by offering SUSHI tokens as an additional reward on top of the standard liquidity provider rewards from fees.

The SUSHI token also allows holders to participate in community governance and receive a portion of the exchange’s trading fees. SushiSwap’s launch was seen as an evolution in DeFi, allowing users to have a more significant say in the protocol’s direction and economics, a concept known as ‘community governance’.

No, SushiSwap does not require Know Your Customer (KYC) verification. As a decentralized exchange (DEX), it operates on an automated market maker (AMM) protocol that allows users to trade directly from their wallets without the need to create an account or provide personal information.

SushiSwap maintains the ethos of decentralized finance (DeFi) by offering a platform where users can maintain custody of their funds and engage in trading and liquidity provision anonymously.

Yes, SushiSwap is a decentralized platform, which means it operates on a distributed network without a central authority. The protocol is governed by community votes, where SUSHI token holders can submit proposals and vote on changes to the protocol.

Its infrastructure is based on open-source smart contracts that run on the Ethereum blockchain, allowing users to interact with the protocol directly from their cryptocurrency wallets. SushiSwap’s decentralized nature is part of the wider decentralized finance (DeFi) movement, emphasizing transparency and user control over assets.

SushiSwap, like other decentralized exchanges and DeFi protocols, carries certain risks, but it has been designed with safety in mind. It operates using smart contracts on the Ethereum blockchain, and since its launch, the SushiSwap team, along with its community and core developers, have taken measures to secure the protocol.

The smart contracts have been audited by reputable firms. However, as with any cryptocurrency-related activity, users should exercise due diligence, understand the protocol’s features, and be aware of the inherent risks of trading digital assets and providing liquidity, including smart contract vulnerabilities and market volatility.

SushiSwap User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for SushiSwap - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.