Pros

Cons

Quick Summary

| Headquarters Location | Liverpool, UK |

|---|---|

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR, NZD + 12 others |

| Total Supported Cryptocurrencies | 250+ |

| Trading Fees | Not Listed |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency |

| Support | Facebook, Twitter, Instagram, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android |

Welcome to our comprehensive review of Wirex, a digital payment platform which promises a smooth experience when engaging in digital assets such as Bitcoin or Ether. Let’s see what this platform has in store!

Wirex continues to make waves in the financial industry by providing an innovative platform that simplifies interaction between digital and traditional currencies. Their commitment to seamless experiences can be seen as they continuously update and enhance their offerings to meet users’ evolving needs.

Wirex has continued its impressive trajectory due to its remarkable adaptability and foresight in navigating the rapid tempo of digital finance.

About Wirex

Wirex began its journey with the mission to make cryptocurrencies accessible and understandable to everyone, everywhere. Established by Pavel Matveev and Dmitry Lazarichev in 2014, its headquarters is in London; with additional offices located in Kiev, Tokyo and Atlanta.

Wirex Card has become an incredible boon to customers around the world who prefer cryptocurrency transactions for everyday purchases, extending services into over 130 countries and earning themselves an enthusiastic customer following among crypto enthusiasts and those using digital coins for everyday transactions.

Wirex has successfully navigated the turbulent waters of the cryptocurrency industry since its establishment, facing significant shifts in market trends and regulatory landscapes. Their journey demonstrates an ability to adapt and innovate when facing new challenges such as shifts in regulatory policies in different jurisdictions – including adhering to strict standards established by Financial Conduct Authority in UK and Bank of Lithuania respectively.

In Hong Kong and the Czech Republic, where digital finance has rapidly gained ground, the company has expanded its operations.

Wirex has a number of active social profiles including Facebook, Twitter, Instagram, LinkedIn, Discord, Reddit, TikTok and YouTube.

Wirex has a mobile app on both the Apple App Store and Google Play.

Trading Experience

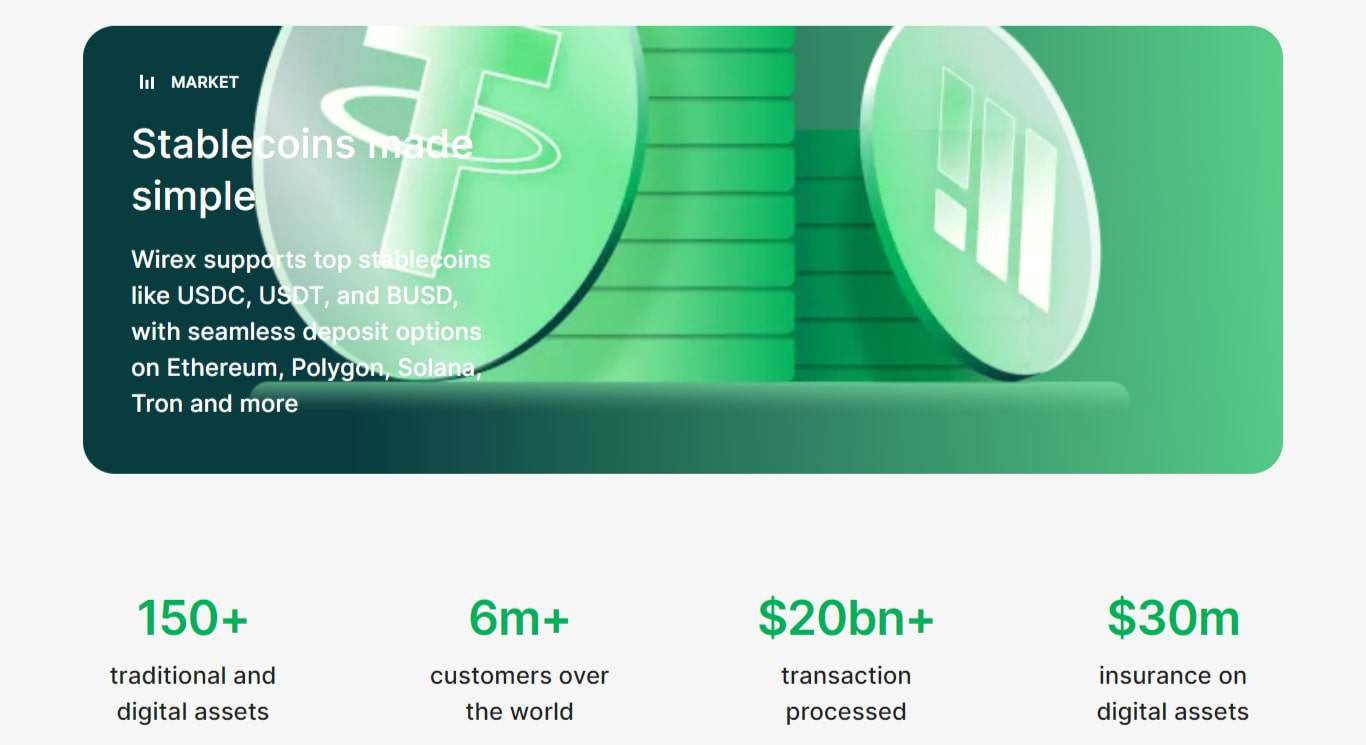

Wirex strives to offer an intuitive yet comprehensive trading experience, catering both to novice and seasoned traders alike. The platform facilitates exchange of both popular cryptocurrencies and traditional currencies while offering tools and features designed to simplify trading process.

Crypto enthusiasts appreciate how easy and safe it is to exchange cryptocurrencies and manage their assets within this platform.

Wirex provides a high-quality trading experience for a broad spectrum of users, from newcomers to cryptocurrency trading to experienced traders seeking efficiency and reliability. Its design takes into account all aspects of trading – offering real-time charting tools, competitive exchange rates, and an assortment of cryptocurrencies for trading.

Features such as the Wirex Token enhance trading experiences by providing users with additional benefits.

Wirex Fees

Wirex takes great pride in its straightforward fee structure, which was carefully created to suit a range of transactions without incurring steep costs. They achieve this through competitive exchange rates combined with service fees such as ATM withdrawals and monthly card maintenance fees that tailor specifically to different services they provide.

Fee models should provide value while protecting the platform’s robust infrastructure.

Wirex strives to offer an accessible yet sustainable service, and their transparent fees structure enables users to manage their finances without fear of hidden charges.

This approach has proven instrumental in building trust with their customer base. Fees such as ATM withdrawal charges and monthly card maintenance costs are set with an eye toward maintaining infrastructure costs while providing users with information for making informed financial decisions.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% |

| Deposit Fee (Credit/Debit Card) | 0% |

| Trading Fee | Not Listed |

| Withdrawal Fee (Bank Transfer) | 0% |

Wirex supports a range of different cryptocurrencies with varying withdrawal fees. When looking at Bitcoin, they don't charge anything above the standard Bitcoin network fee. Across all the crypto exchanges we've reviewed, the average Bitcoin transaction fee charged is 0.000594 BTC compared to the actual network fee of 0.000473 BTC. This means you are saving 20.34% on Bitcoin transactions by using Wirex instead of other exchanges.

Security - Is Wirex Safe?

Wirex understands the significance of security for digital payments and cryptocurrency services, offering features such as two-factor authentication, robust card issuance measures, and cold storage for crypto assets.

Wirex has also earned itself a strong reputation for adhering to stringent regulatory compliance measures, holding an official license from the Financial Conduct Authority of UK.

Wirex goes far beyond standard protocols employed by cryptocurrency exchanges to protect customer funds and information, using cutting-edge technology to safeguard them against unauthorised access.

Wirex takes an aggressive stance toward security with their implementation of two-factor authentication and cold storage solutions that demonstrate their commitment to maintaining an atmosphere that emphasizes trust and reliability in line with industry requirements.

Wirex Customer Support

Wirex customer support team is well-recognized for its dedication in serving their users. Users may reach them either via email address or the platform’s internal support system.

Though user experience varies, users generally feel Wirex provides adequate support and strives for an outstanding customer service experience.

Wirex’s customer support framework is tailored to provide timely and helpful assistance for its users. Given the prevalence of negative reviews within the crypto space, customer support services serve as a critical resource for anyone needing guidance or clarification.

Wirex customer support team’s dedication in offering responsive support in an expedient manner reflects their commitment to providing a positive customer service experience and responsive support services.

Wirex Support Channels

How to Sign Up on Wirex

- Create Account - Visit the Wirex website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the deposit methods listed below.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Wirex Alternatives

Binance

Total Supported Cryptocurrencies

386+

Trading Fees

0.10%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

Kraken

Total Supported Cryptocurrencies

244+

Trading Fees

0.08% - 0.40%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 1 other

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Final Thoughts

Wirex stands out as a dynamic player in the crypto industry, offering services designed to cater to modern digital asset users. Their innovative Wirex Card holds immense appeal for anyone wishing to integrate cryptocurrency assets alongside traditional currencies in everyday life.

Wirex FAQs

Yes, Wirex is a legitimate company operating in the digital payment platform space. Founded by Pavel Matveev and Dmitry Lazarichev in 2014, Wirex offers a Wirex Card, which is a Visa debit card that allows customers to make everyday purchases using cryptocurrencies and traditional currencies.

The company emphasizes security with robust security measures such as two-factor authentication (2FA) and cold storage for crypto assets. Wirex adheres to regulatory compliance standards, is headquartered in Hong Kong, and operates in various countries, allowing users to engage in trading and exchange cryptocurrencies on its platform.

Customers can also earn crypto rewards through its Cryptoback™ Rewards program for card spending. The Wirex Token (WXT), a native token, offers additional benefits like reduced fees.

To withdraw funds from your Wirex account, you can transfer money to an external wallet or bank account, make ATM withdrawals using the Wirex Card, or spend your funds directly with the card. The process involves logging into your Wirex account, selecting the amount of money you wish to withdraw, and choosing your withdrawal method.

Remember that there may be a fee structure associated with different types of withdrawals, such as ATM withdrawal fees or card fees. Ensure that your account has gone through the necessary verification process for security reasons.

For any assistance, Wirex customer service can provide guidance.

Yes, Wirex requires an identity verification process to comply with financial industry regulations and ensure the security of its customers and their funds. This process includes providing a government-issued ID, and potentially additional documents, to prevent fraud and maintain a secure trading environment.

The requirements for the identity verification process might vary depending on your region due to differing regulatory compliance standards.

To withdraw money from Wirex, you have several options. You can transfer funds to an external wallet or bank account, use the Wirex Visa card for ATM withdrawals, or spend the funds directly with merchants accepting Visa.

The withdrawal process typically involves selecting the amount you wish to withdraw within your daily limit, choosing the withdrawal method, and confirming the transaction. Be aware of any withdrawal fees, card fees, and the exchange rate applied to the transactions.

Confirm the details via email if required, and use two-factor authentication for an added layer of security.

The Wirex Card incorporates multiple security features to protect customers’ funds and data. It uses industry-standard security measures such as two-factor authentication (2FA), robust security measures in the transaction process, and cold storage for crypto assets to reduce the risk of unauthorized access.

The card also allows users to instantly freeze and unfreeze their card details through the app if they suspect any fraudulent activity. However, like all financial platforms and products, it is important for users to use the card responsibly and to be vigilant of their card and account security.

Yes, the Wirex Visa card enables card holders to perform ATM withdrawals worldwide, subject to daily withdrawal limits and potentially an ATM withdrawal fee. This allows users to access their funds in both cryptocurrencies and traditional currencies, providing them with flexibility for cash withdrawals.

As with any financial transactions, it’s advisable to be aware of the ATM fees and the exchange rates that may apply.

Yes, you can receive money on Wirex from both external cryptocurrency wallets and traditional bank accounts using the Wirex app. To receive funds, you typically need to provide the sender with your Wirex wallet address for cryptocurrencies or your account details for traditional currencies.

The platform supports a variety of cryptocurrencies and traditional currencies, allowing for a seamless experience when transferring assets to your Wirex account. Always ensure that you follow the security protocols, such as two-factor authentication, when receiving funds to safeguard your assets.

Wirex User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Wirex - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.